Last updated: 21 March 2024

Employer Focus – Payroll Changes for 2024-25

Debbie Clarke20 March 2024

Brighten up your payroll knowledge with the new legislation and changes in the Spring Budget for the 2024-25 tax year.

PAYE

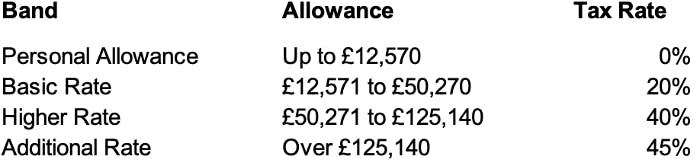

The standard employee personal allowance for the 2024 to 2025 tax year is:

· £242 per week

· £1,048 per month

· £12,570 per year

Tax bands and rates for England, Northern Ireland and Wales

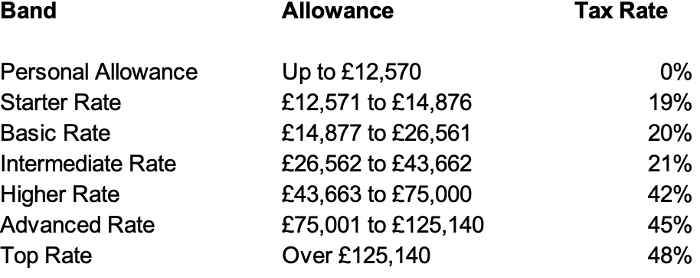

Tax bands and rates for Scotland

National Insurance

In the Spring Budget it was announced that from 6th April 2024, National Insurance will be cut:

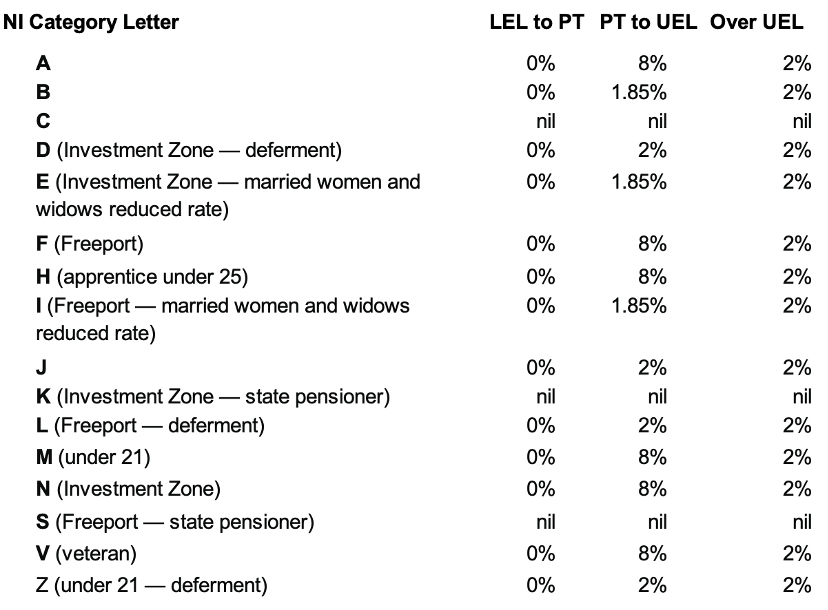

- Class 1: From 10% to 8% for employees

- Class 4: From 8% to 6% for self-employed people

The National Insurance Class 1A rate on expenses and benefits for 2024 to 2025 is 13.8%.

The National Insurance Class 1A rate on termination awards and sporting testimonial payments for 2024 to 2025 is 13.8%.

The National Insurance Class 1B rate for 2024 to 2025 is 13.8%.

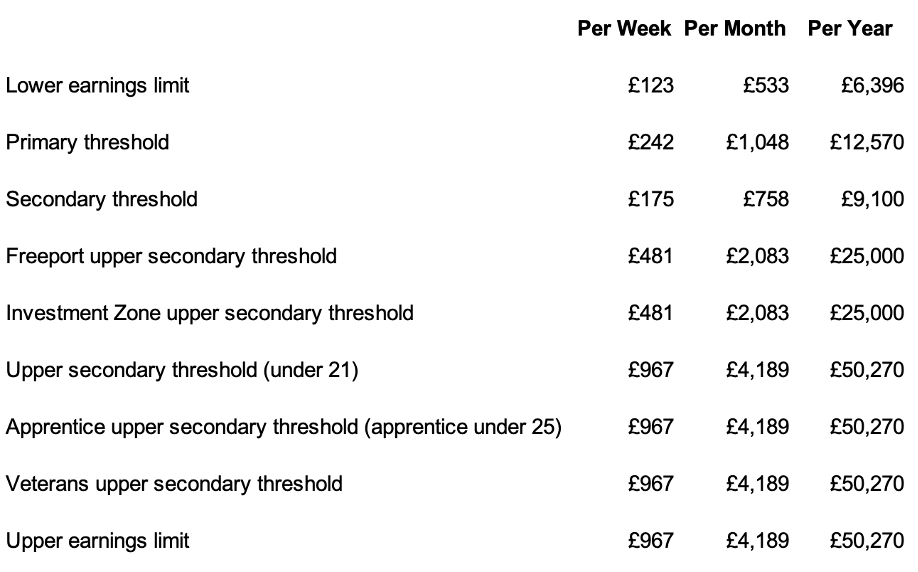

Class 1 National Insurance Thresholds

Class 1 National Insurance Rates

Employee (primary) contribution rates

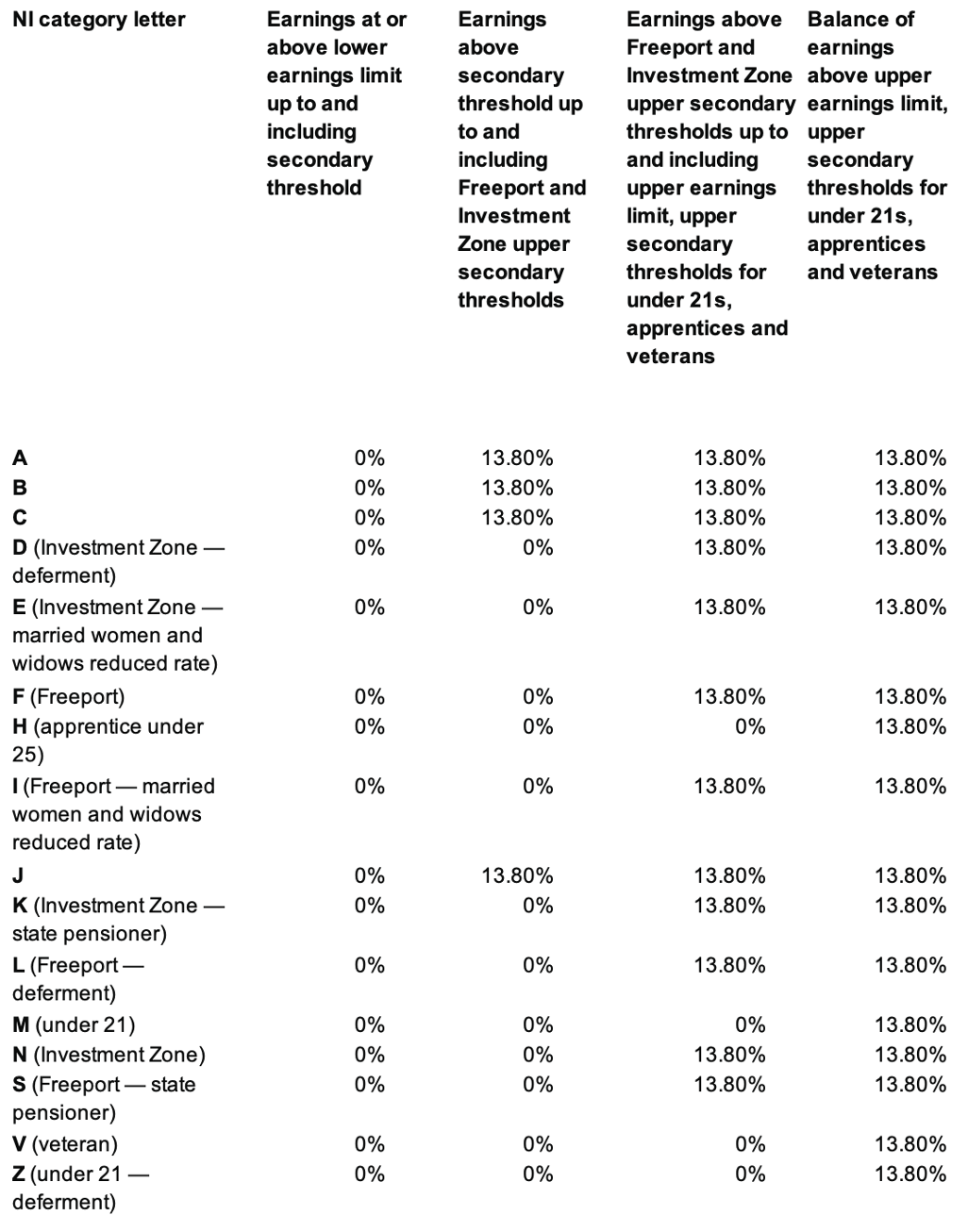

Employer (secondary) contribution rates

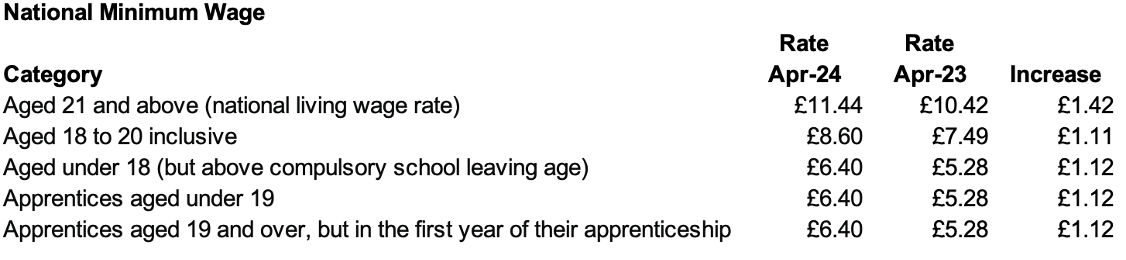

National Minimum Wage change from 1st April 2024

An Employee on the Minimum Wage over 21 that works 160 hours a month will see a decrease of £103.87 in Employee NIC in 2024-25 compared to 2023-24 with an overall increase in Net Pay of £1,670.67 for the tax year 2024-25 in comparison to 2023-24 due to the increase of the National Minimum Wage and the decrease in the Employee NIC to 8%.

Student Loan Rates

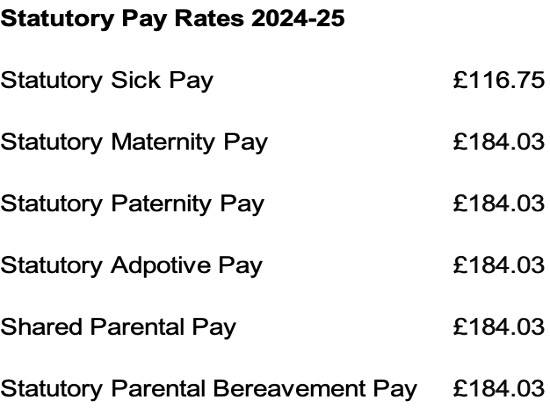

New Statutory Rates

The new Statutory Sick Pay rate is applicable from 6th April 2024 and the new parental statutory pay rates are applicable from the first Sunday in the new tax year – 7th April 2024.

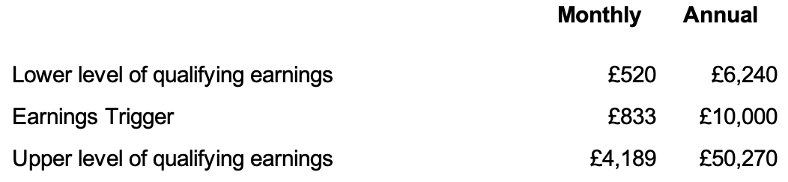

Automatic Enrolment

The thresholds for the 2024/2025 remain the same as the previous three tax years.

Employment Allowance

The Employment Allowance remains the same at £5,000.

Apprenticeship Levy

The Apprenticeship Levy rate remains at 0.5% and the allowance does not change from £15,000.