BrightPayLast updated: 27 February 2023

Student loan repayment thresholds and rates for the 2023/2024 tax year

Elaine Carroll23 January 2023

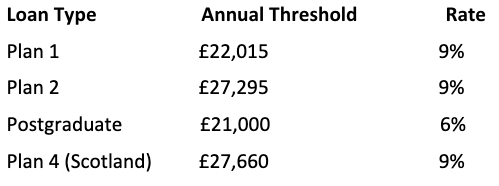

In August 2022, it was confirmed that the student loan annual threshold for those on Plan 1 loan types would rise for the 2023/24 tax year. It was also confirmed that the Plan 2 annual threshold would remain frozen. The 2023/24 thresholds for Postgraduate and Plan 4 loan types were confirmed in February 2023. The 2023/24 thresholds will be applicable from the 6th of April 2023.

Any employee earning above their threshold will be required to make student loan repayments. The employee will pay back a percentage on the income they earn above their threshold. When the employee begins to pay back their loan and how much they pay depends on which plan they are on. Find out more about the different repayment plans here.

2023/2024 Student loan repayment thresholds and rates:

Read HMRC guidance for more information and to learn what to do if an employee has more than one loan type.

What the employer is responsible for

- Making deductions of student loan repayments from an employee's earnings

- Keeping records of the deductions made

- Paying the deductions over to HMRC

- Providing HMRC with details of the deductions within each FPS submission

- Giving employees details of their deductions on their payslips and P60 certificate

- On an employee’s P45, indicating if student loan deductions should continue

3 ways which an employer can be instructed to begin to making loan deductions

1) Direct instruction from HMRC:

HMRC will issue an SL1 start notice to tell an employer to start making deductions for a student loan (Plan 1, Plan 2 or Plan 4). The SL1 will contain the plan type that must be operated. HMRC will issue a PGL1 start notice to tell employers to start making deductions for a Postgraduate loan type. On your Online PAYE account, you may also receive a Generic Notification Service (GNS) reminder message from HMRC to start deductions.

2) Instructions on a new employee’s P45 to say that student loan deductions should continue:

If the new employee does not know an employee’s loan type, the employer must operate a Student Loan Plan 1. The employee should contact the Student Loan Company to confirm their correct loan types.

3) Instruction from a Starter Checklist completed by a new employee:

The employer should set up the loan deductions as indicated by the questions on the Starter Checklist.

The student loan repayment figures will apply to all current and future borrowers for whom employers make student loan deductions. In the 2023/24 version of Bright’s payroll software, BrightPay, the new student loan repayment thresholds will automatically be calculated, and the appropriate student loan deduction applied. It’s essential that employers stay up to date on all relevant student loan thresholds and repayment rates for the upcoming tax year. Being aware of these changes will help you make sure you are making the correct deductions and avoid any potential penalties from HMRC.