BrightPayLast updated: 27 April 2023

Can you use HMRC Basic PAYE Tools for auto enrolment?

Eleanor Vaughey17 April 2023

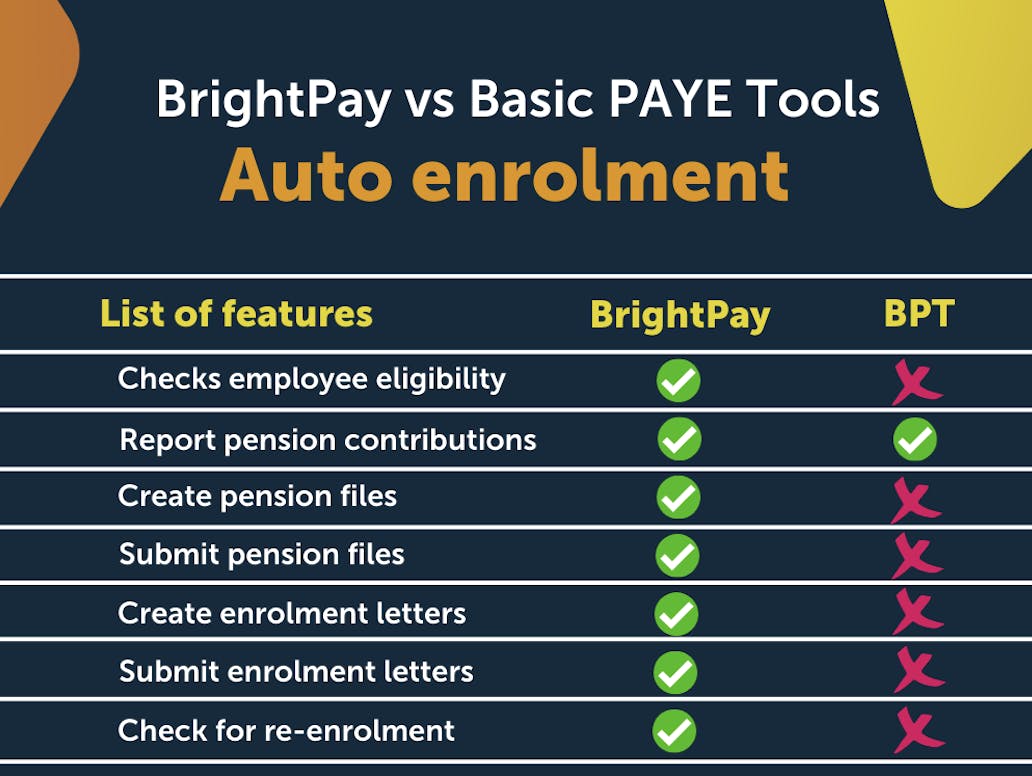

Still using HMRC’s Basic PAYE Tools to comply with your auto enrolment duties? While their toolkit provides a spreadsheet to indicate who needs to be enrolled and contribution values, there are many duties that it doesn’t cater for, such as re-enrolment and producing pension files. While there are some workarounds, the time these take just add on to your already sky-high to-do list.

Using Basic PAYE Tools requires a lot of manual work in order to fulfil your auto enrolment duties. Moreover, if any errors occur, like contribution miscalculations or improper communication, they can take quite a lot of time and money to rectify. For example, if you make a mistake that impacts pension contributions, you’ll need to make backdated payments and you could face penalties for non-compliance. Improper communication, like not providing staff with enrolment letters, could also put you at risk of non-compliance. With 20,382 compliance notices made between July and December of 2021, it’s apparent that auto enrolment compliance issues are affecting businesses all across the UK. So while you might think using a manual system like HMRC’s PAYE Basic Tools is saving you money, in the long run, it’s really not.

How can I prevent auto enrolment penalties?

So how can you prevent fines and penalties from The Pensions Regulator? Well, we recommend for businesses to use payroll software that caters for and can even automate auto enrolment duties. Bright’s payroll software, BrightPay, has some auto enrolment features that can help you save time, as well as give you peace of mind that you’re complying with your auto enrolment duties.

1. Checks employee eligibility for you

BrightPay works in the background for you by constantly monitoring your employees’ auto enrolment eligibility. Once an employee becomes eligible, on-screen alerts will notify you of any auto enrolment duties you need to perform.

2. Creates your enrolment letters

It’s your legal duty to send out an enrolment letter to each employee within six weeks after your duties start date. This letter must explain how automatic enrolment applies to them. BrightPay can take the wheel from here by generating enrolment letters for you, tailored to each employee. They’re sent out directly through the payroll software too – so no need to type out dozens of emails from scratch. If you use our cloud-extension, BrightPay Connect, you can send enrolment letters easily to a secure app on their smartphone, where they can be viewed, downloaded or printed at any time.

3. Submit pension files straight from the system

Not only does BrightPay help get you set up with auto enrolment, it also helps you keep up with your auto enrolment duties each pay period too. Rather than manually exporting pension files and having to upload them to your pension provider’s portal, you can do it all from within BrightPay. If you use NEST, The People’s Pension, Smart Pension or Aviva, you can submit pensions files to your provider directly through the software. Our direct integration with these pension providers not only saves you time, it also helps to reduce any errors or mistakes that may crop up from switching between the different platforms.

4. Reminds you of your re-enrolment dates

Re-enrol-what? A lot of employers are aware that they need to enrol employees and submit pensions files, but what about re-enrolment? It’s something that can be easily overlooked. However, re-enrolment is as much of a legal requirement as all the other tasks we’ve mentioned prior. Re-enrolment is when you put certain staff who have left your pension scheme back into it. This should be done every three years and is a legal requirement. If you fail to re-enrol employees, it could lead to penalties from The Pensions Regulator.

When you reach your re-enrolment date (work out your re-enrolment date here), you must re-enrol eligible employees back into a pension scheme and send them their enrolment letters within six weeks of enrolment. Then, you must submit a declaration of compliance to The Pensions Regulator (even if you haven’t re-enrolled any staff) within a six-month window of the third anniversary of their previous enrolment anniversary.

BrightPay essentially does all of the re-enrolment heavy lifting for you. Like we mentioned previously, eligibility is monitored and enrolment letters can be sent from directly within BrightPay – same goes for re-enrolment eligibility and re-enrolment letters. It continuously checks which employees are eligible for re-enrolment, with alerts on screen of the auto enrolment duties you need to perform. The re-enrolment letters are personalised to each employee, saving you heaps of time each time re-enrolment comes around.

More of a visual learner? Here’s a quick checklist of our auto enrolment functionality in comparison to Basic PAYE Tools.

To find out more about your duties regarding auto enrolment, head over to the Pensions Regulator website. Even if you don’t think you have auto enrolment duties, you still may have to perform certain tasks by law, so it’s always best to check there first.

Ready to streamline your auto enrolment workload? Give BrightPay a try. Book a free demo today, or if you can’t wait for a demo, download a free trial of our multi-award-winning payroll software.