Tax and accounts compliance tools to make your life easier with BrightTax

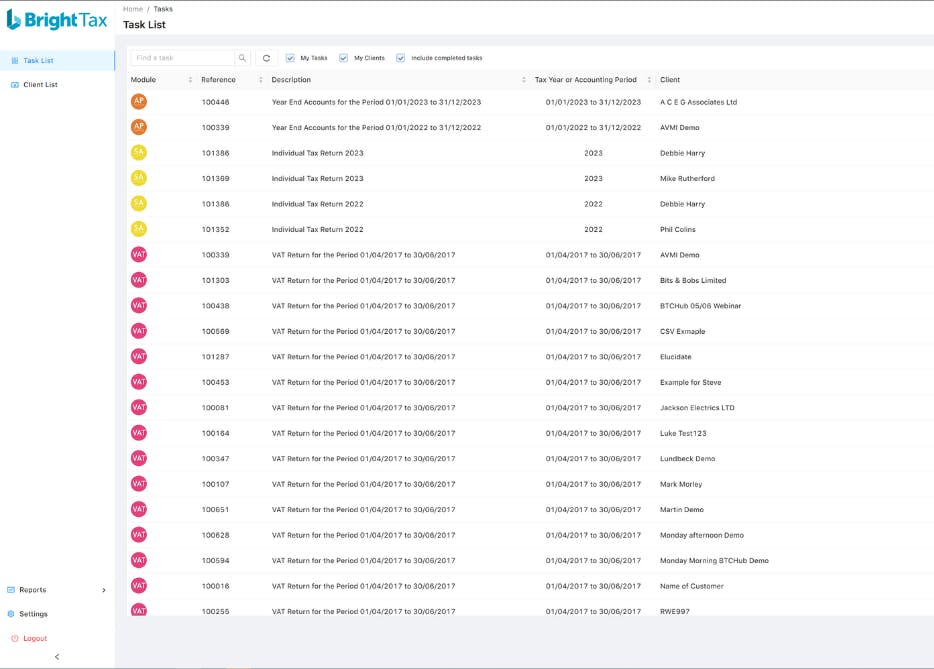

Manage client tasks from your online dashboard

Use BrightTax’s live dashboard to manage client tasks, while tracking their status.

- Manage tax and accounts tasks and deadlines

- Search for and filter clients quickly

- Easily switch between Self Assessment and corporate clients

- Intuitive, user-friendly interface

Fly through Self Assessment tax returns

File individual tax returns directly to HMRC, while staying compliant with UK Self Assessment tax regulations.

- Generate accurate tax returns in minutes

- File SA100s and supplementary documents directly to HMRC

- Automated calculation of deductions and credits and data verification

- Real-time HMRC warnings plus comprehensive internal error checks and validations

- Built in capital allowances calculator

Streamline financial reporting

From reconciling accounts to generating financial statements, BrightTax automates financial reporting, with customisation to suit your practice.

- Two-way integration with bookkeeping software including, Quickbooks, Xero and Sage

- Automatic iXBRL creation, tagging, and submission to HMRC and Companies House

- FRS 102 Section 1a and FRS 105

- Supports sole traders, limited companies (small), limited liability companies (small), micro entities and partnerships

- Transfer data between Accounts Production and Corporation Tax to save you time

Prepare and file Corporation Tax returns with ease

Intuitive CT600 software allows you to effortlessly move through your clients Corporate Tax returns thanks to automated calculations, bookkeeping integrations, and one-touch iXBRL tagging.

- Integrated with HMRC

- CT600 plus supplementary schedules

- Automatically produce iXBRL tagging

- Move data from Corporation Tax to Accounts Production using the tax journal

- Built in capital allowances calculator for main pool and special rate pool

Effortlessly comply with Making Tax Digital for VAT

BrightTax's VAT filing module provides quick and easy MTD for VAT compliance that supports clients, no matter how they keep their digital records.

- Create MTD returns from multiple sources, including Group VAT capability

- Transfer your client data from Excel files

- Transfer your client data from integrations with bookkeeping software

- Submit your VAT return data directly to HMRC

Save time with integrations with HMRC, Companies House and bookkeeping software

Integrations with HMRC, Companies House and bookkeeping software allows you to speed up the UK tax and compliance process, while ensuring accuracy.

Enjoy automated compliance with iXBRL filing

Built-in compliance with UK iXBRL rules for annual accounting, saving you time across tax and accounts compliance.

Enhance client management with our practice management software integration

Our client management integration with BrightManager helps you to stay on top of clients' tax and compliance, and much more.

And more coming soon!

Get access to updates as we add them, including integrations with other Bright products like BrightManager and BrightPay, as well as eSigning solutions and even more legacy bookkeeping software.