Discover how AccountancyManager

and BrightPay work together

Use side by side for a more structured and organised payroll process.

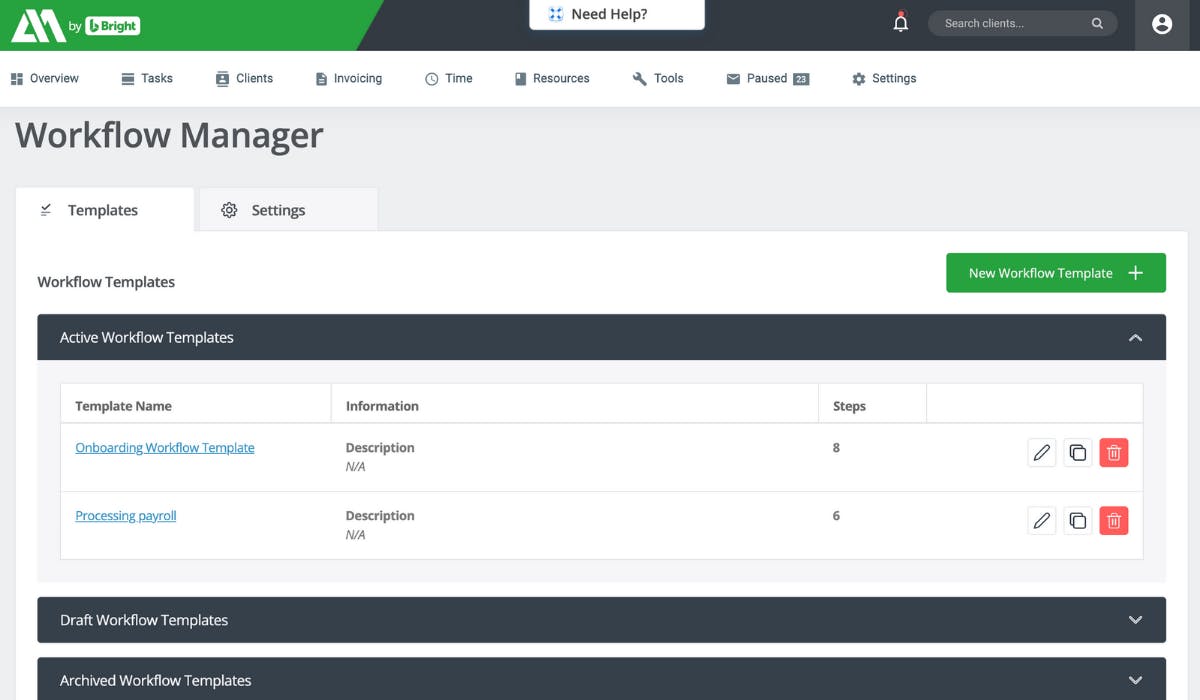

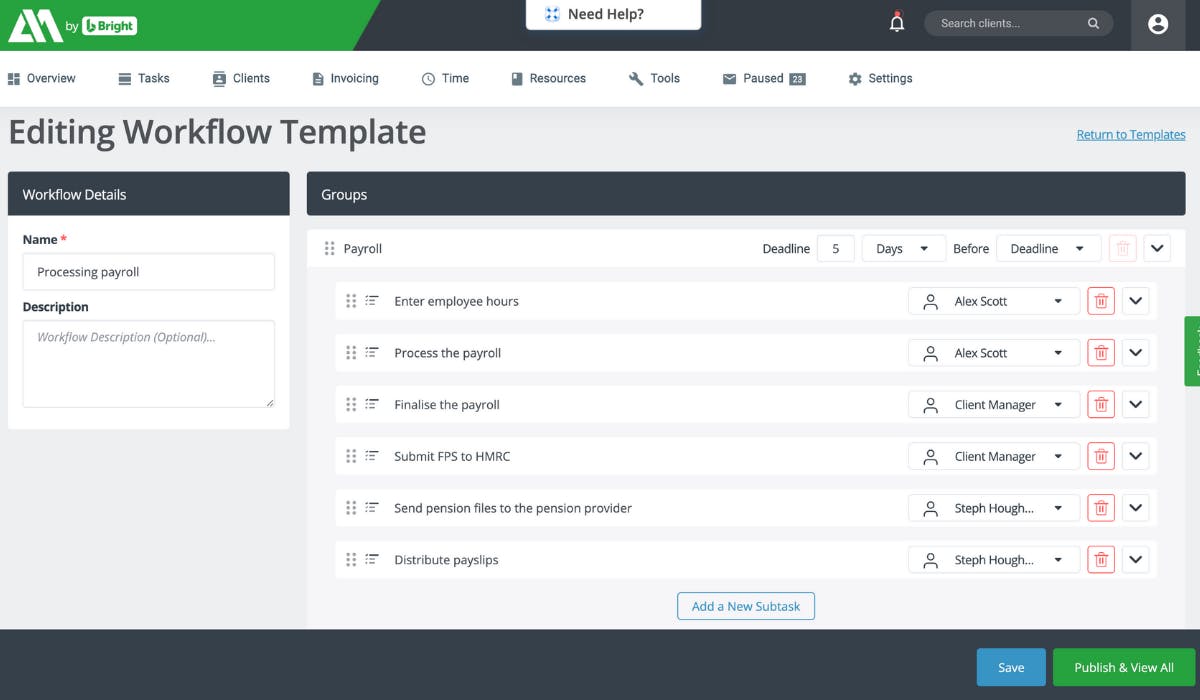

Create a payroll workflow

In AccountancyManager, you can create a new workflow and add the payroll tasks that need to be completed each payroll run.

Your payroll workflow will likely include tasks such as:

- Getting the payroll data from the client

- Entering the employee hours

- Finalising the payroll

- Distributing the payslips

You may also decide to include deadlines for sending submissions to Revenue, sending journal records to your bookkeeping software or even making payments to employees.

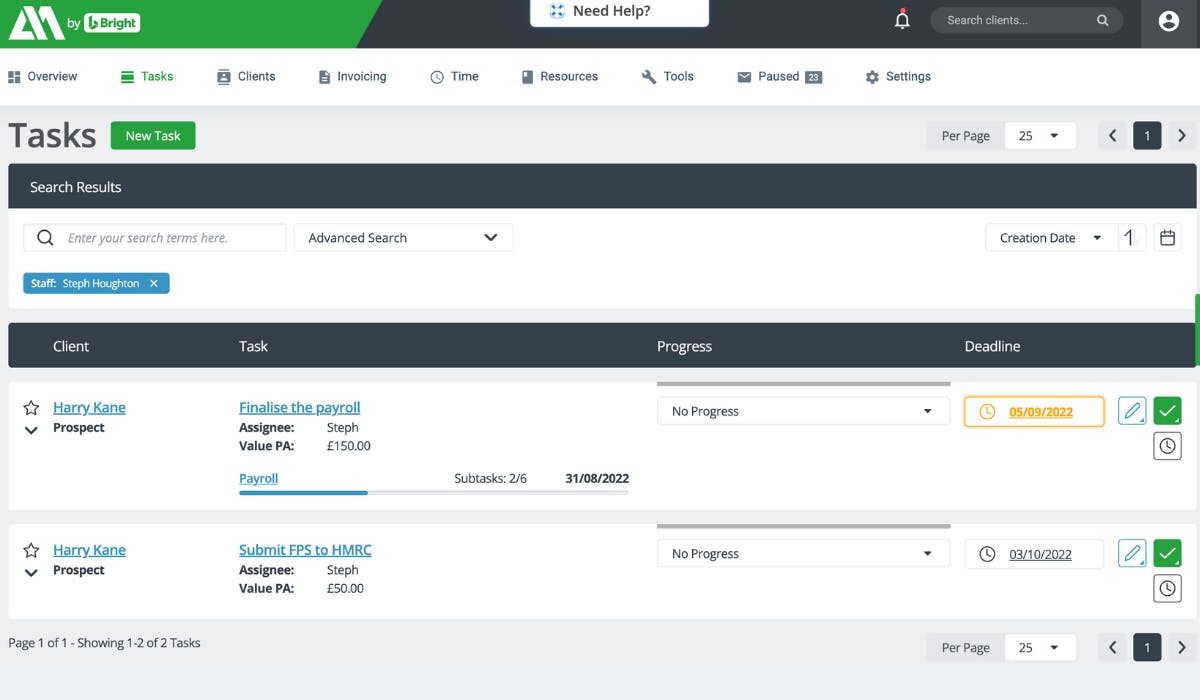

Manage your payroll tasks

The task list in AccountancyManager will show which assignments need your immediate attention, which have missing information, the client that each task relates to, and the deadline for completing a task.

Once the payroll has been processed, simply mark the task as completed and the deadline will automatically move to the next pay period.

Subtasks can be assigned to different team members - each team member can check off their own tasks in AccountancyManager's task list as tasks are completed.

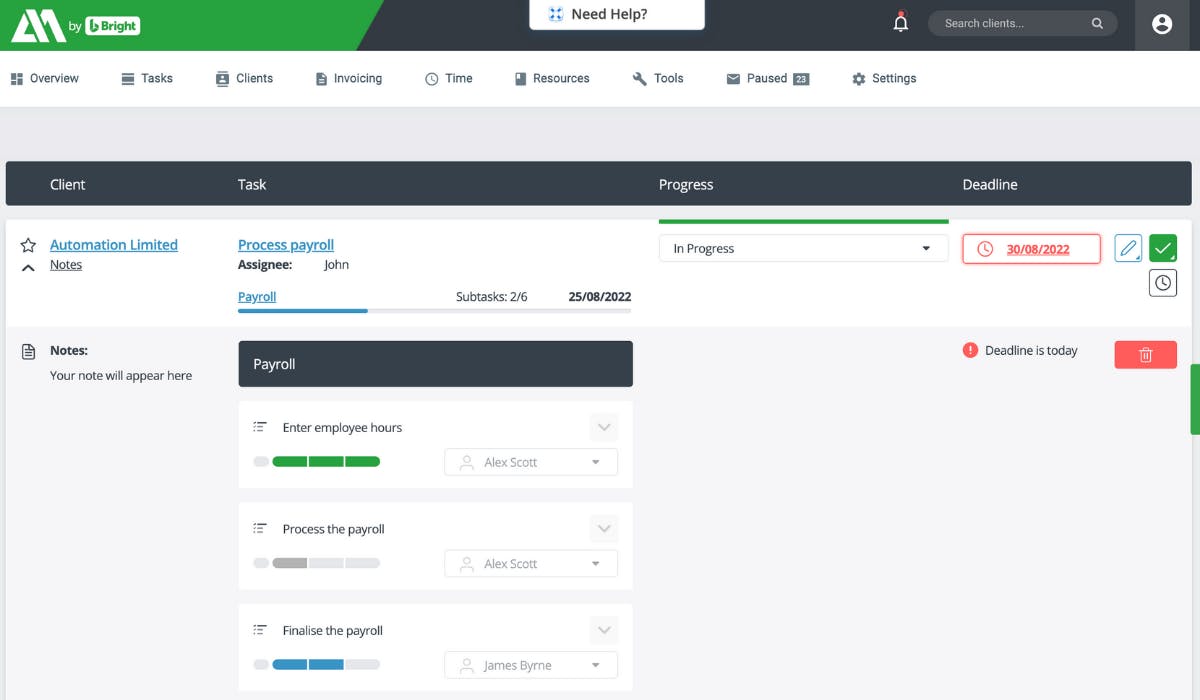

Track your payroll progress

It's easy to keep track of your payroll workflow at a glance with the progress bar. You can also add progress notes for anything specific.

Then, when the payroll is done, simply tick the box to the right of the workflow, marking your payroll as complete for that pay period.

Save your payroll workflow for future use

Save your new payroll workflow as a template and implement it for all of your payroll clients.

Subtasks and task assignees will automatically flow through to the next pay period, and AccountancyManager becomes your one-stop-shop for checking the progress of your clients’ payroll.