BTCSoftware features

20+ years of features developed in collaboration with accountants to make your business run like a dream.

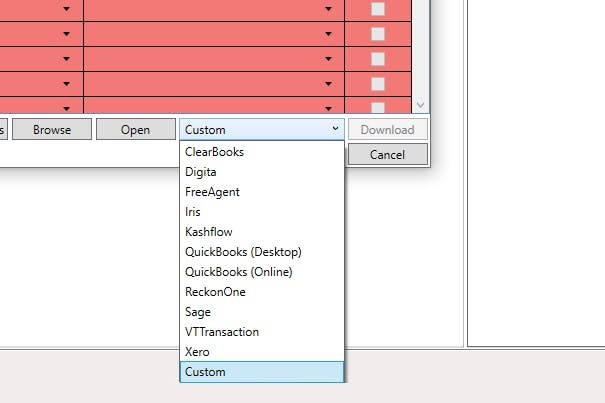

Bookkeeping software integrations

BTCSoftware links with the bookkeeping tools accountants use to create seamless processing, including two-way integrations for easy import and journal posting and trial balance mapping that can save up to 25 minutes per client.

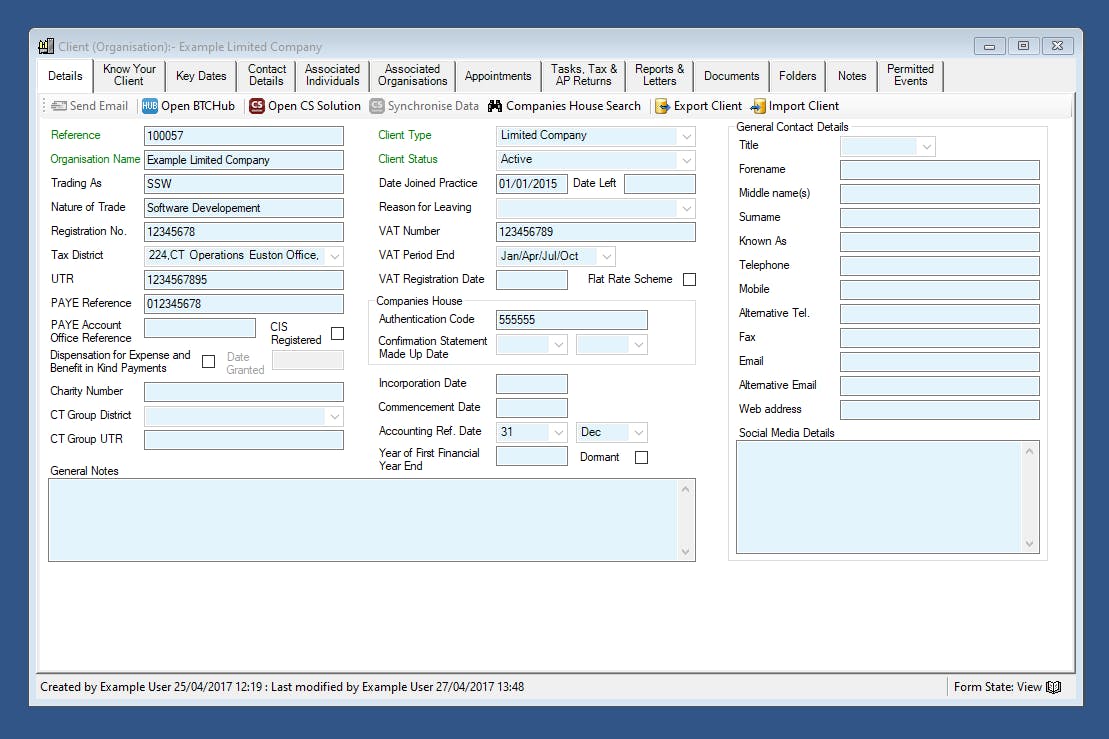

Quick client management

Core client management system gives you quick onboarding tools, accurate key date visibility and GDPR-compliant add-ins for peace of mind.

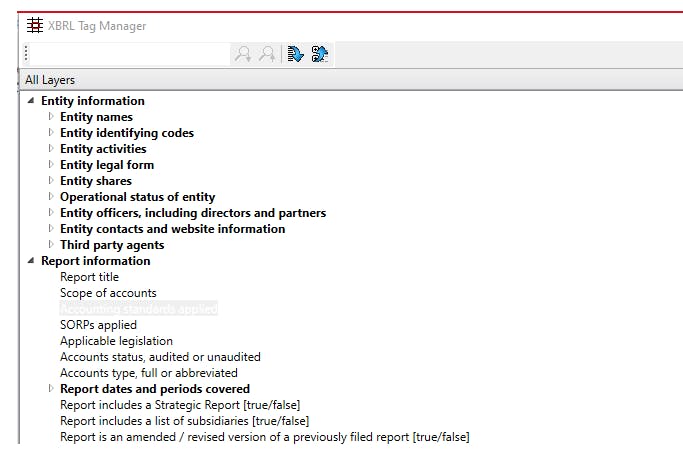

iXBRL tagging in one click

Limited company accounts are fully iXBRL tagged at the touch of a button for fast compliance with Companies House, alongside import and submission support for iXBRL data from third party software.

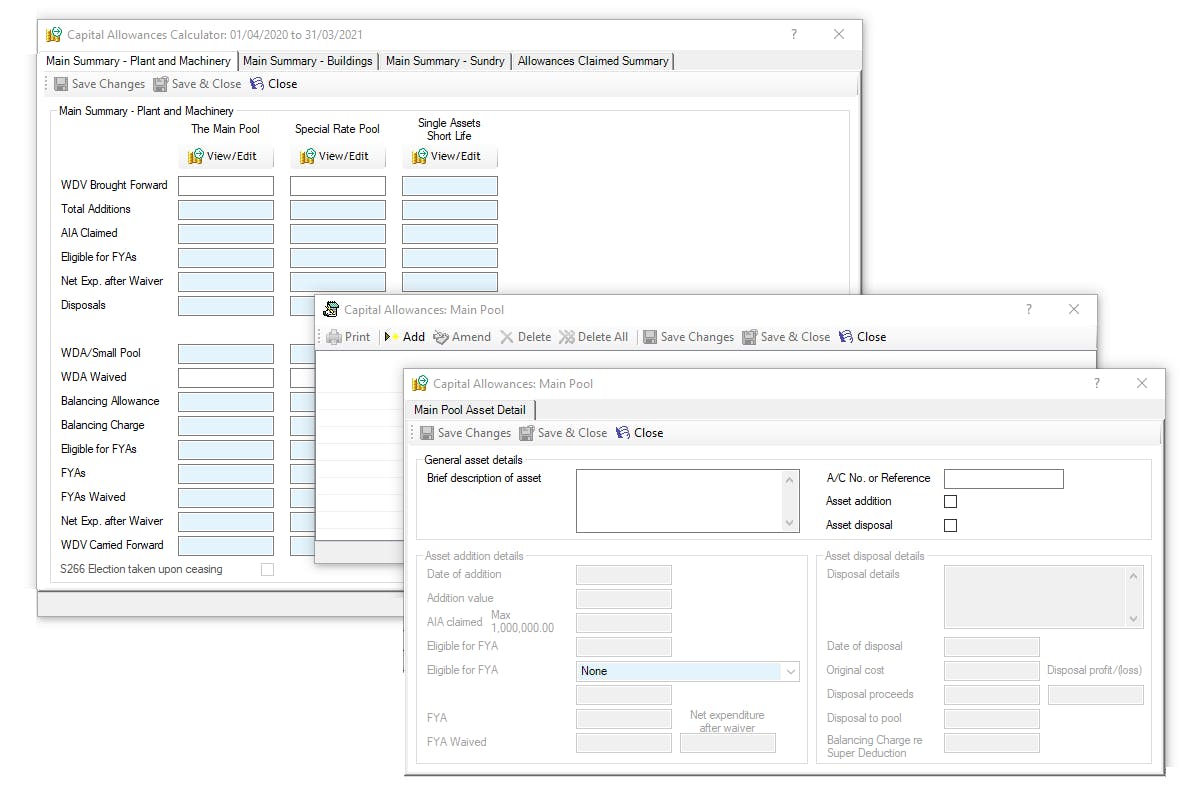

Built-in Capital Allowance calculations

The Corp Tax forms you need in one place include Capital Allowance Calculations, with CT600A, CT600C, CT600D, CT600J & CT600K, plus CT600 supplementary schedules included for Research and Development, Loans to Participators, Group and Consortium, Insurance, Amateur Sports Clubs (CASCs), Disclosure of tax avoidance schemes, and Restitution Tax.

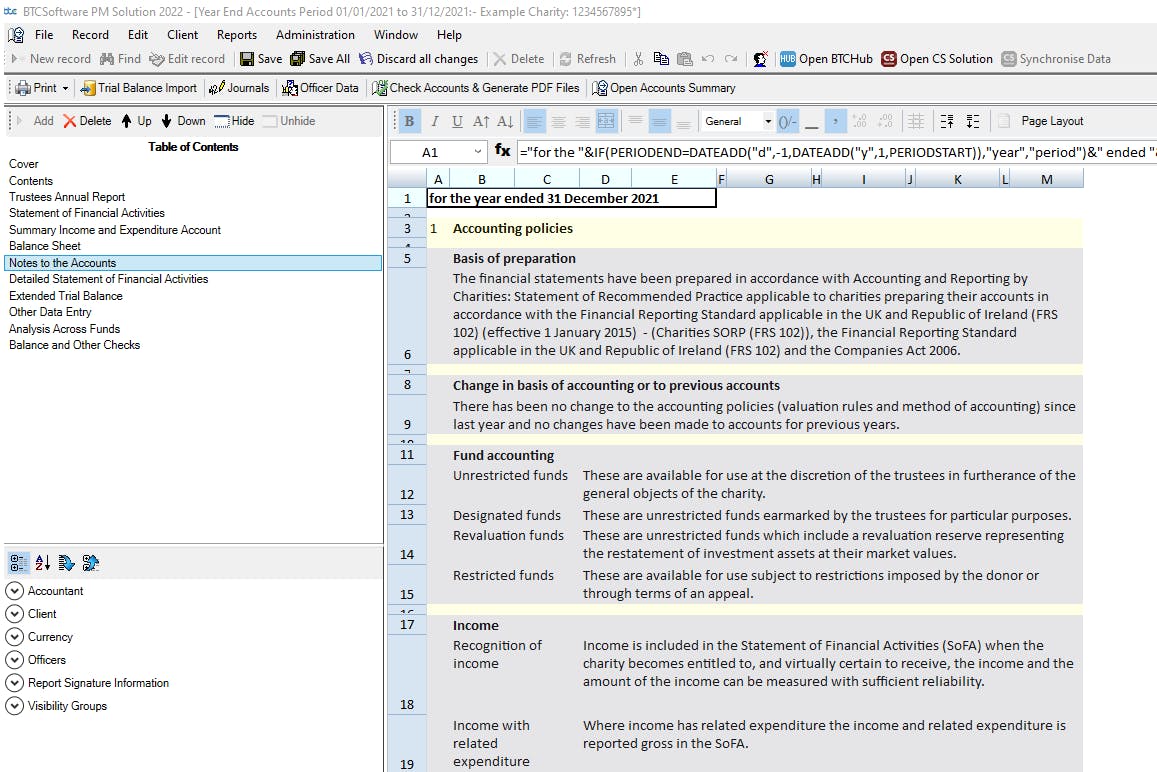

Take care of Charity Accounts

Support Charity Accounts Production and Tax Returns using the FRS 102 SORP template for our Accounts Production module. It creates a time-saving compliance process. Generate the set of accounts, then easily create the Corporation Tax computation for schedule CT600E for simple year-end charity compliance.

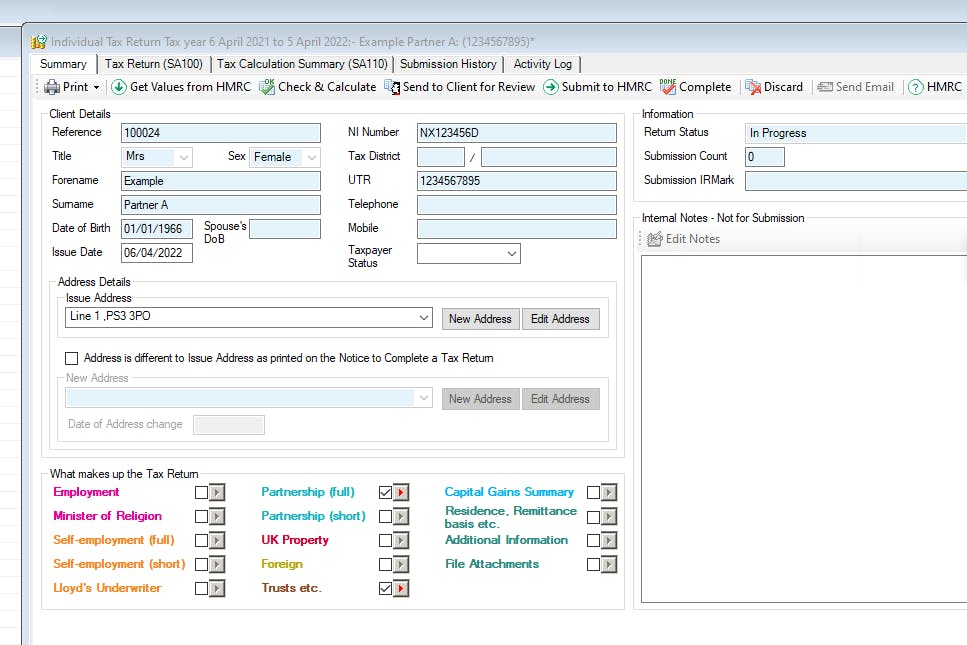

Stress-free Self-Assessment

Make tax season simple using our intuitive layout with context-sensitive HMRC guidance notes and pre-submission validation to reduce errors. Self-Assessment tax return software for SA100 Individual Tax Returns that will enhance your practice, with links to add-on modules for Partnership (SA800) and Trust (SA900 including Estates) Tax Returns.

Work wherever you need to

Securely store and access data on our cloud servers to work wherever you need to, at home, in the office or with your clients. Full online access coming soon!

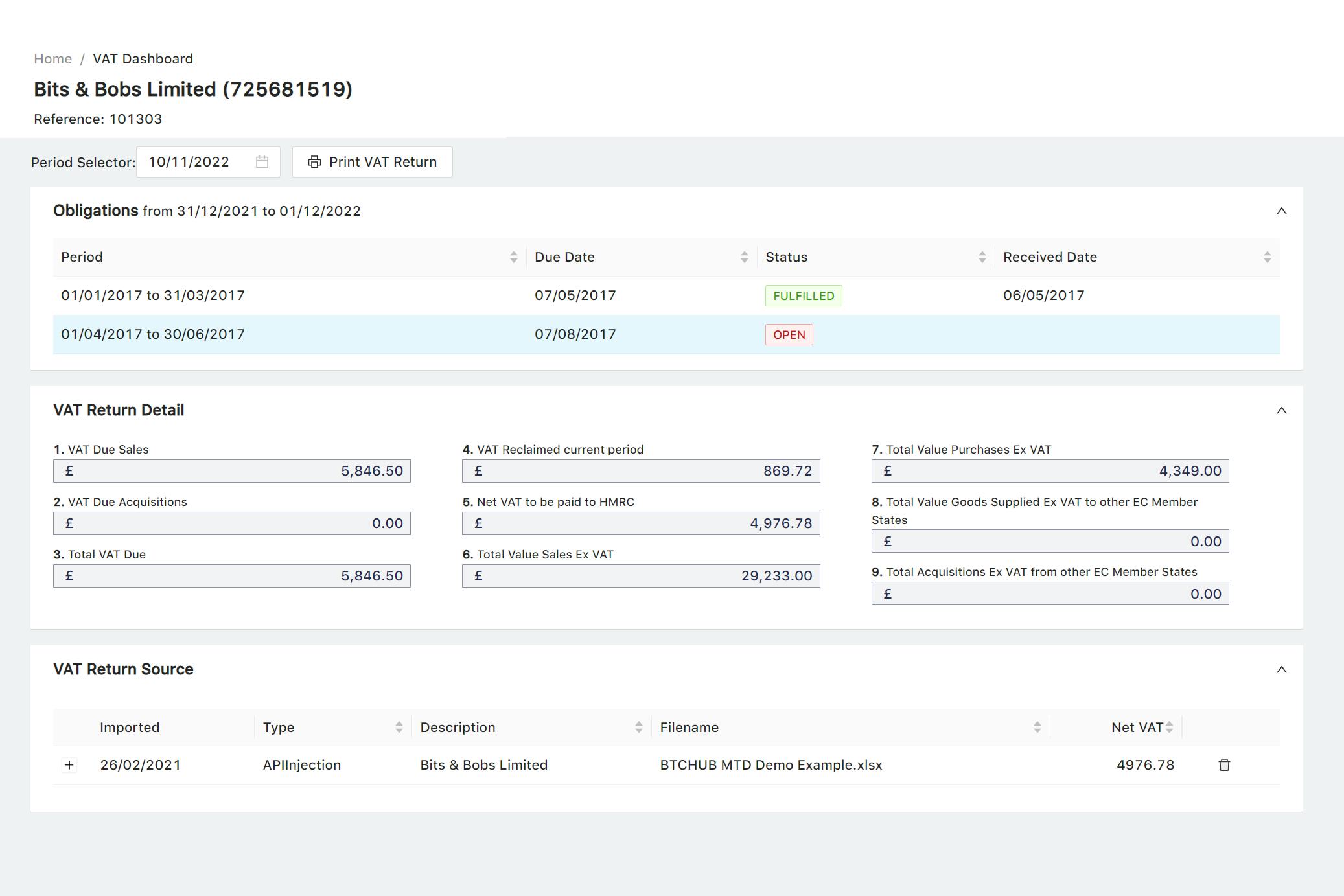

Flexible Making Tax Digital compliance

Even for clients using Excel! BTCHub for VAT provides quick and easy MTD for VAT compliance that supports your clients no matter how they keep digital records. MTD for ITSA coming soon.

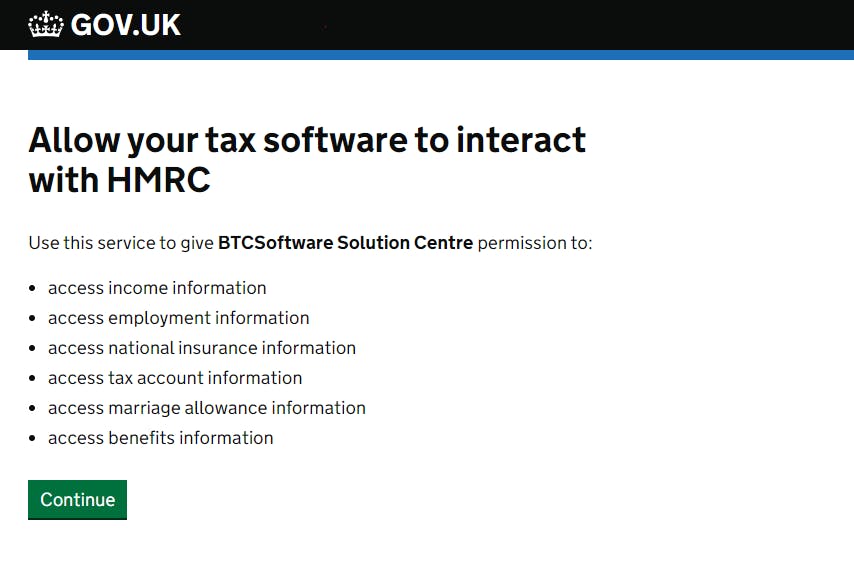

Pre-population of client info

Links to HMRC to pre-populate data already known about tax payers, plus speedy import of client data from PM Core to tax and compliance work – including Officers’ details, registration numbers, Registered Office, Accounting Period.

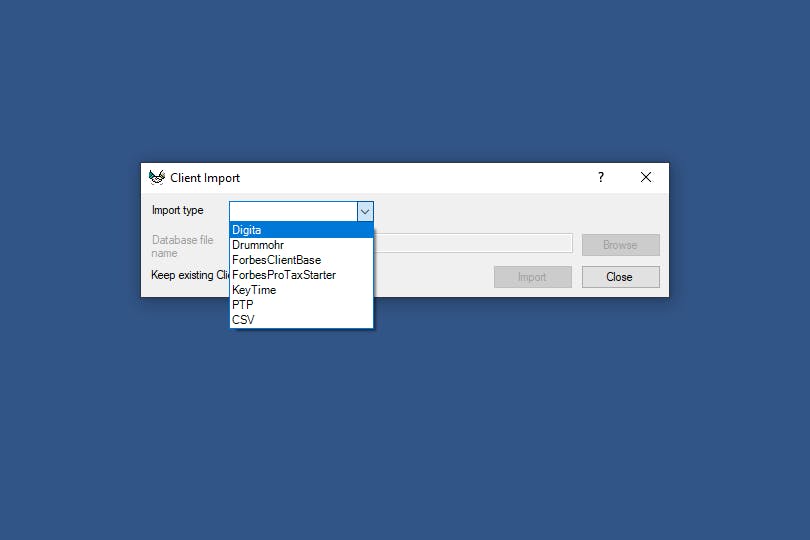

Quick and easy set up

Our team helps you get started with BTCSoftware, from importing standing data to initial training for your users, plus ongoing support when you need it - unlimited, fast and always free!