Making Tax Digital for VAT and ITSA

An easy way to manage MTD for VAT and ITSA,

online and in collaboration with your clients.

HMRC-recognised MTD software

File VAT and Self-Assessment returns directly to HMRC under Making Tax Digital rules.

Online access

Whether you're in the office, working at home or visiting a client, pull up and process UK tax returns anywhere with online access

Use Excel with MTD-compatible bridging links

Work with clients keeping Excel digital records for Making Tax Digital and remain fully-compliant with HMRC MTD rules

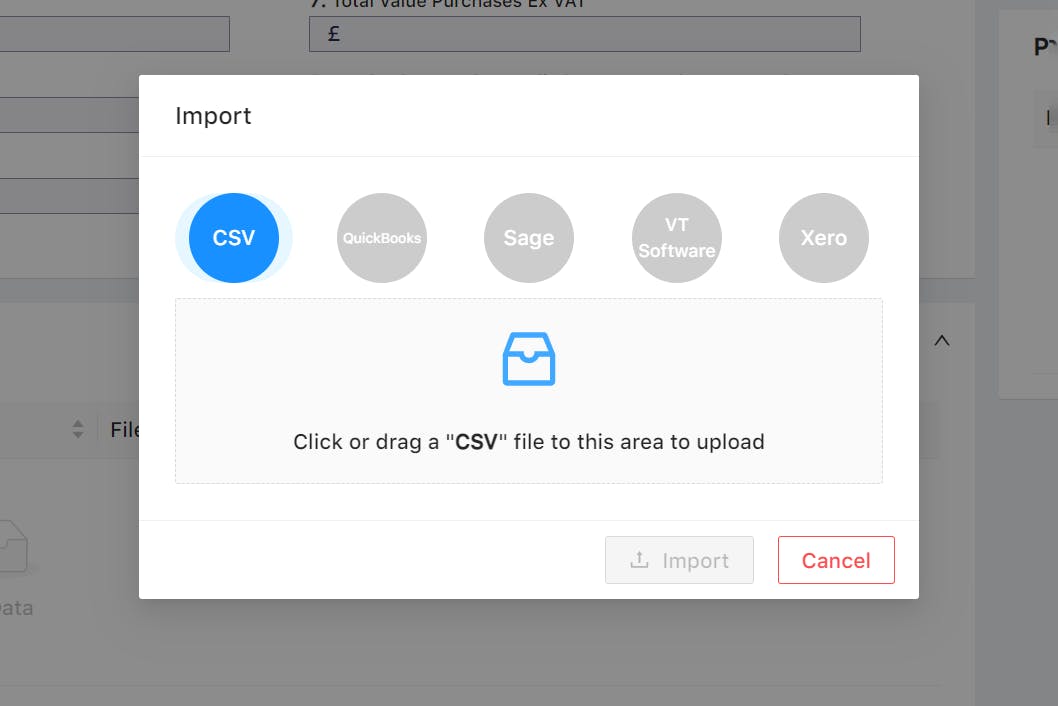

Flexible imports and integrations

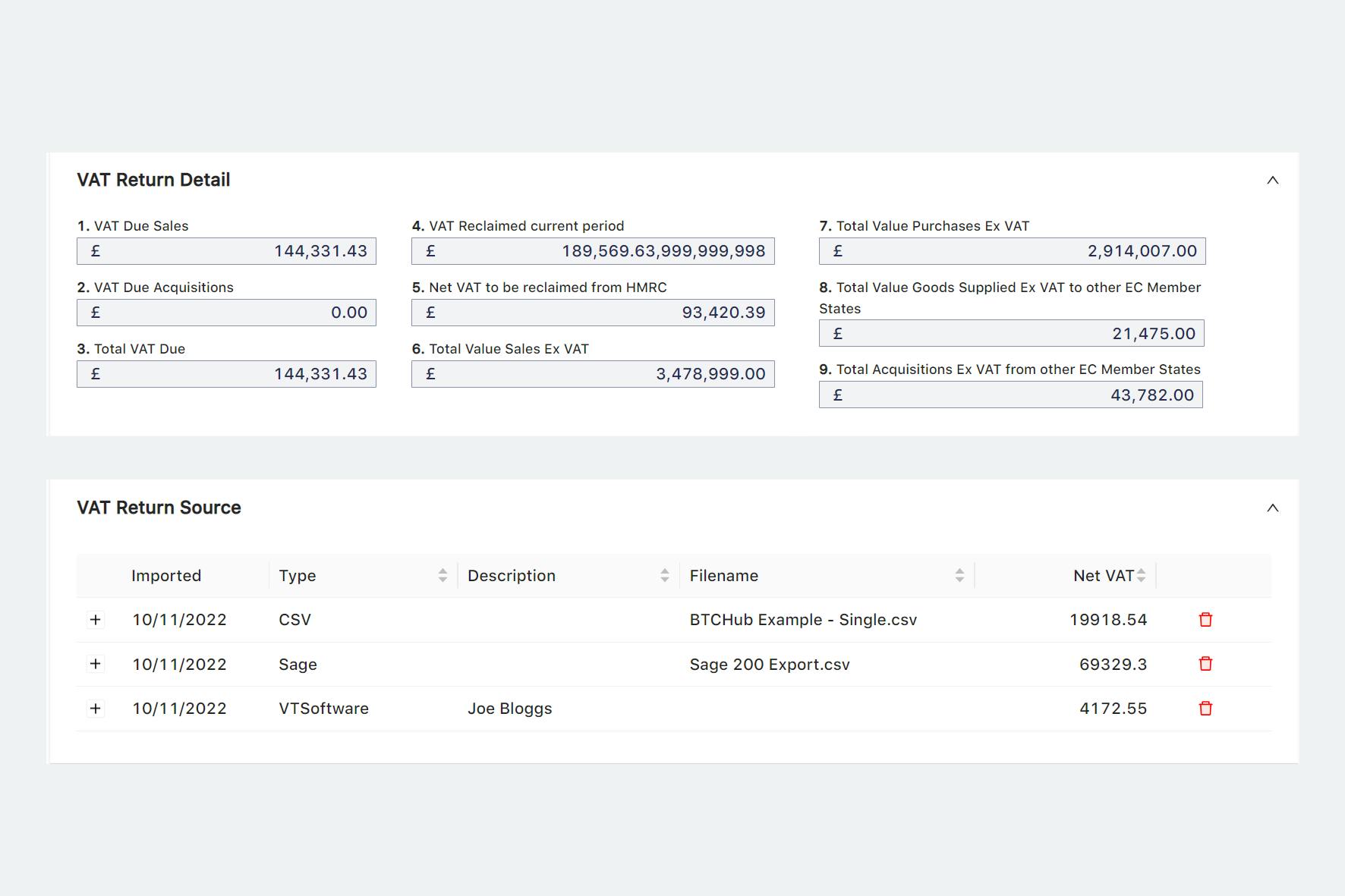

Use our integrations with FreeAgent, QuickBooks and Xero to quickly import bookkeeping data while also supporting clients on legacy systems using our easy CSV import interface

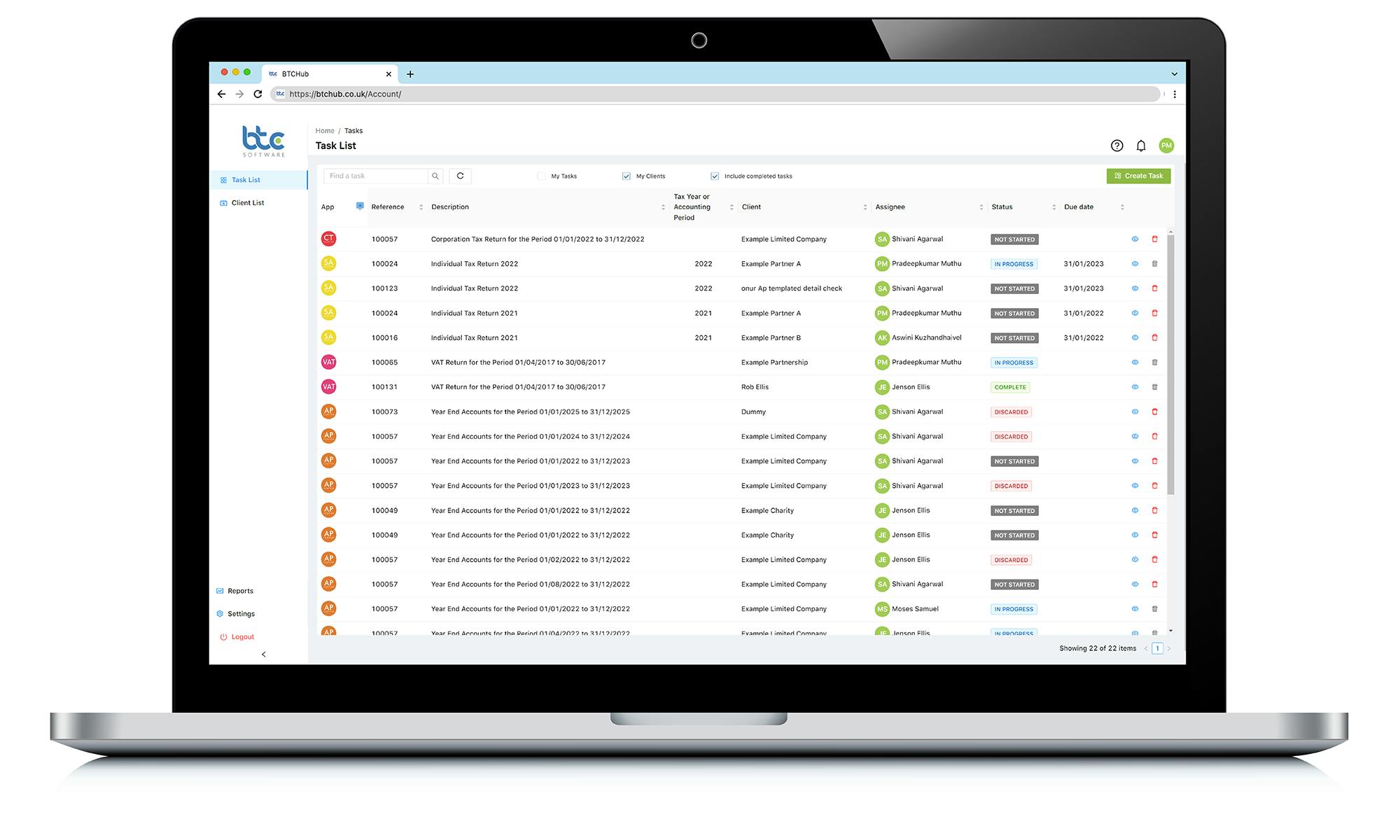

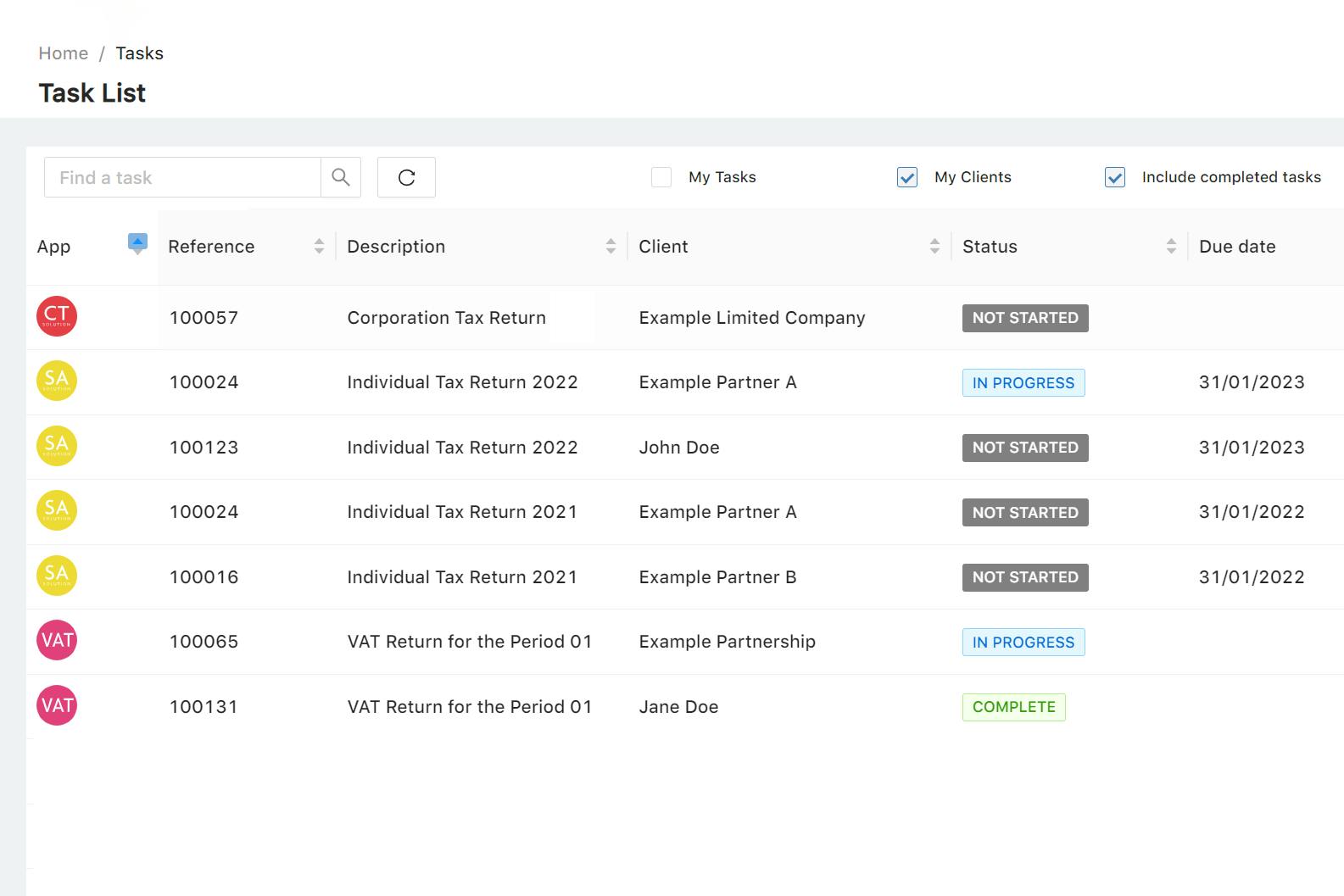

Dashboard view to stay on top of work

Use the dashboard for a quick and easy view of upcoming VAT and Self-Assessment returns so you never miss a deadline

Group VAT returns in just a few clicks

Processing Group VAT returns from multiple sources is quick and simple.