Last updated: 13 April 2023

How to help streamline your AML checks

Eleanor Vaughey11 April 2023

Anti-money laundering – it's a hot topic these days. With new cases popping up all the time and the government declaring interest in becoming the next base for the EU AML Authority (set for 2024). In fact, over 35,000 Suspicious Transaction Reports were received by the Financial Intelligence Unit Ireland in 2021. Hollywood loves a good money laundering story too – one of the most well-known examples being the fictional character Gus Fring from Breaking Bad – he laundered his drug dealing money through Los Pollos Hermanos and Lavandería Brillante.

We’re all aware of money laundering – when income (e.g. cash, property, vehicles) from criminal activities (e.g. drug dealing, commercial fraud, theft) is disguised as if it’s coming from a legitimate source. Although rare in Ireland, taking on a client who launders money isn’t totally unheard of. Have you or a firm you know ever taken on the odd ‘problem client’? Maybe one that’s involved in an industry you have little to no experience with, or conducts activities that aren’t necessarily ‘dodgy’ but just don’t quite fit the bill?

Your AML responsibilities

As an accountant, you’re legally required to report on any suspicious activity (you can use GoAML for external STRs), go through KYC processes, and conduct risk assessments and customer due diligence. While these may seem like monotonous and arduous admin, they help safeguard you, your firm and the profession. Signs of money laundering to watch out for could include reluctance in providing information, cash-based businesses, property transactions with unclear fund sources, and rapid turnover rates (view the full list here).

As you’re probably well aware, in order to do this, you must have proper procedures in place to conduct both a whole firm and individual risk assessments for all of your clients. These must be kept up to date at all times. However, there are some firms out there that have outdated risk procedures in place – such as not keeping adequate records, not training staff in AML procedures – the list goes on.

While there’s a vast range of software to choose from that can help cut down on AML admin, we thought we’d show you how Bright’s multi-award-winning practice management solution, AccountancyManager, can support you in jumping through your AML hoops.*

Simplifying AML with AccountancyManager

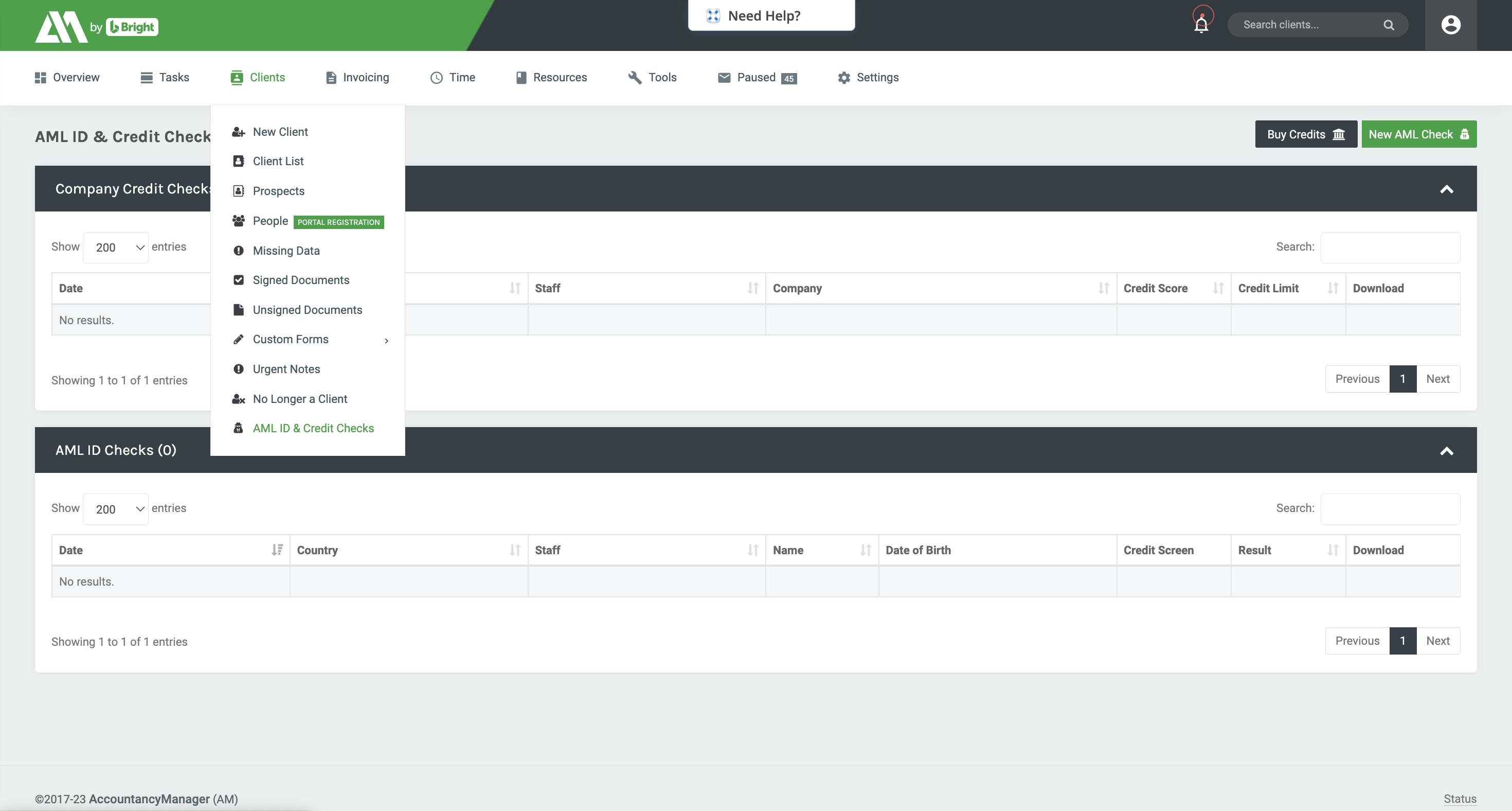

You can undertake ID checks and risk assessments within AccountancyManager. These have been guided and thoroughly checked by former HMRC tax investigator, John Groves. In the AccountancyManager menu, go to Clients > AML ID & Credit Checks > Buy Credits. Purchase however many credits you see fit (don’t worry – they don’t expire). Once you do that, you can go back to the menu and choose Clients > AM ID & Credit Checks > New AML Check. Here’s an image of what it looks like below.

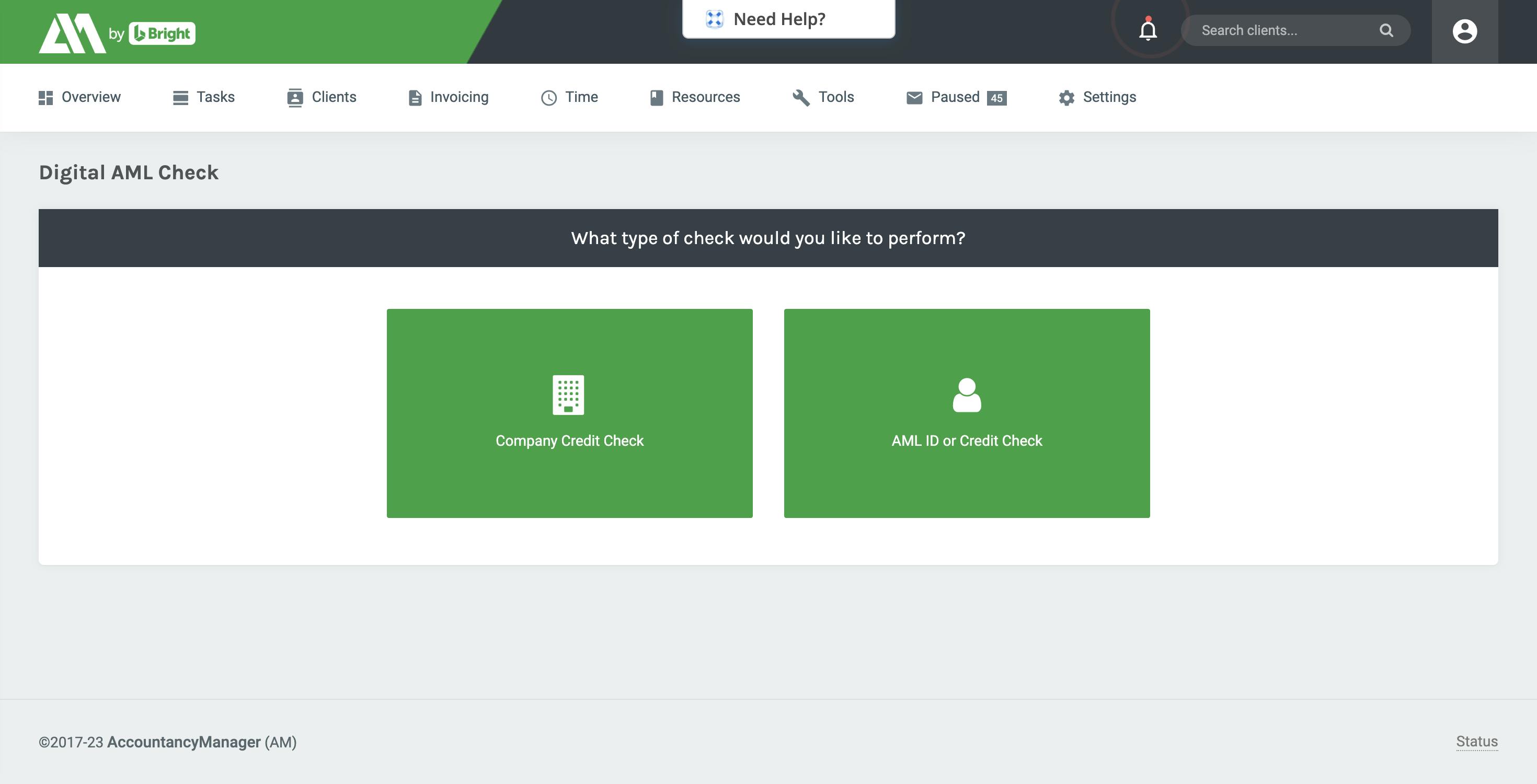

You can then click into AML ID Check or Credit Check (Please note: we don’t offer Credit Checks in Ireland). Pop in the clients’ details and any additional data (passports, driving licence, etc.).

The result will appear in the system, letting you know whether it’s passed or failed the check. Our AML ID checks are done through Veriphy, which check against LexisNexis, Experian, and Equifax to verify these details. You can do checks with either clients or prospects. That way, if you’re questioned as to why you didn’t take on a particular client, you have these failed AML checks as a reason. This automated approach to ID checks cuts down on the time you spend onboarding too – and who doesn’t want that?

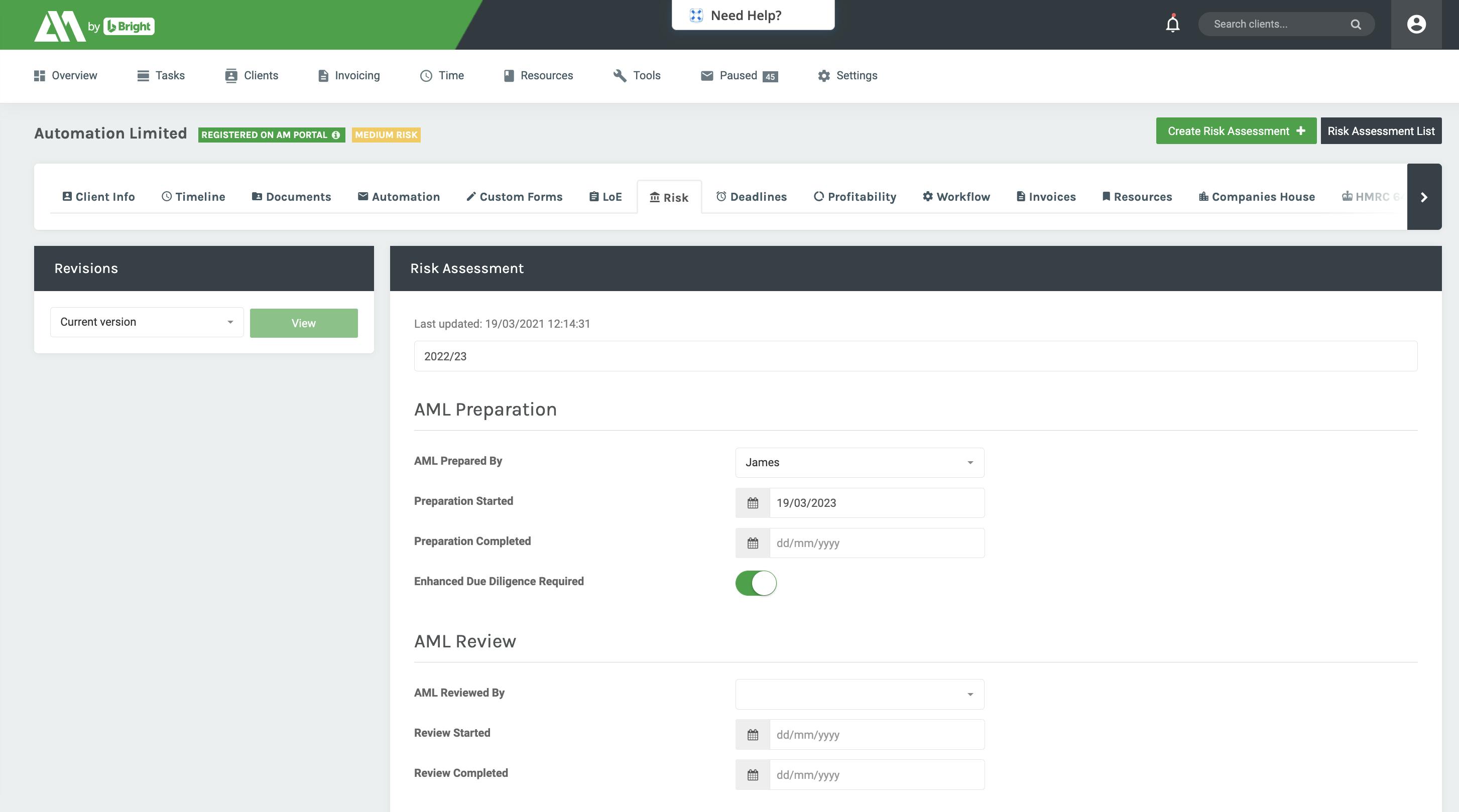

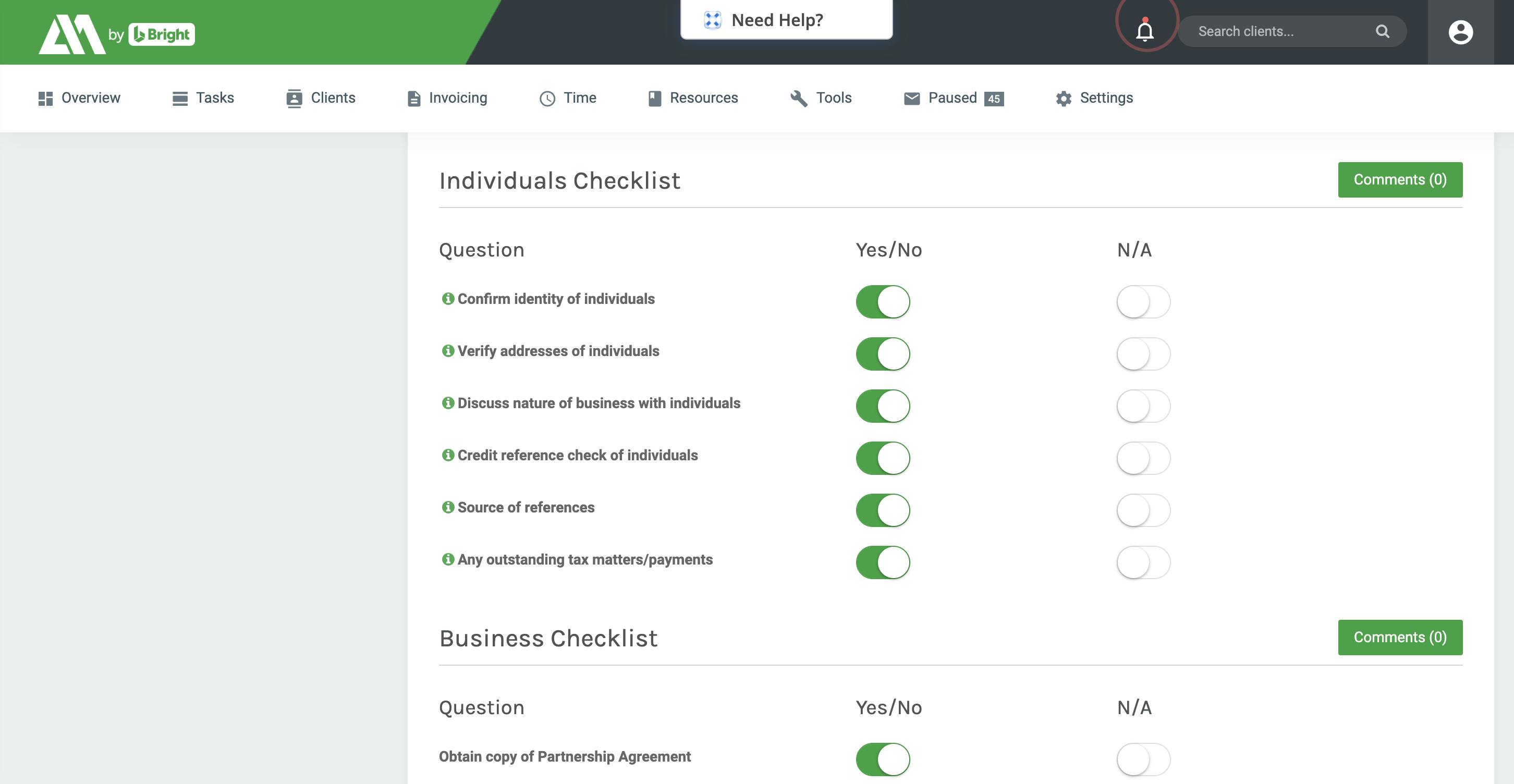

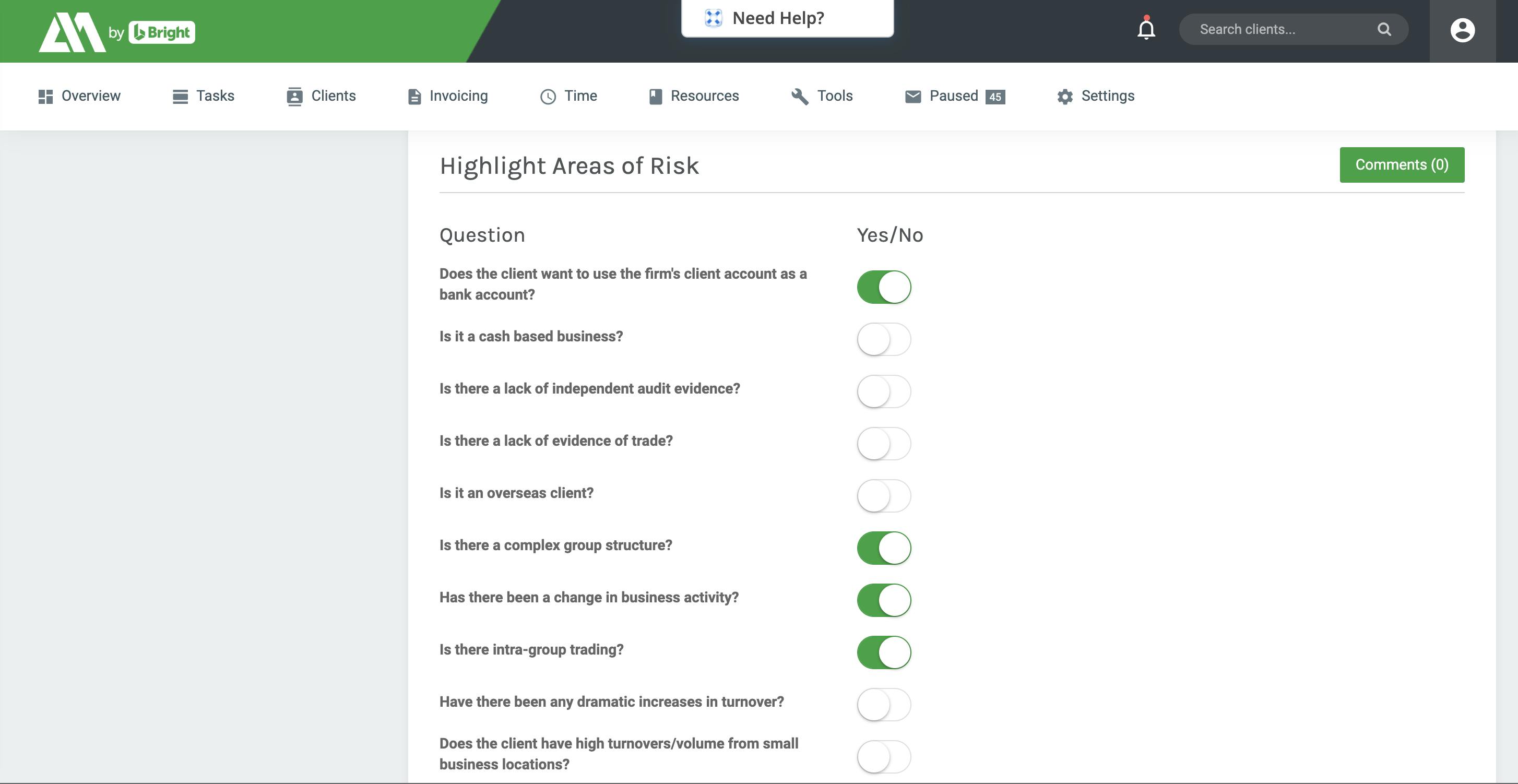

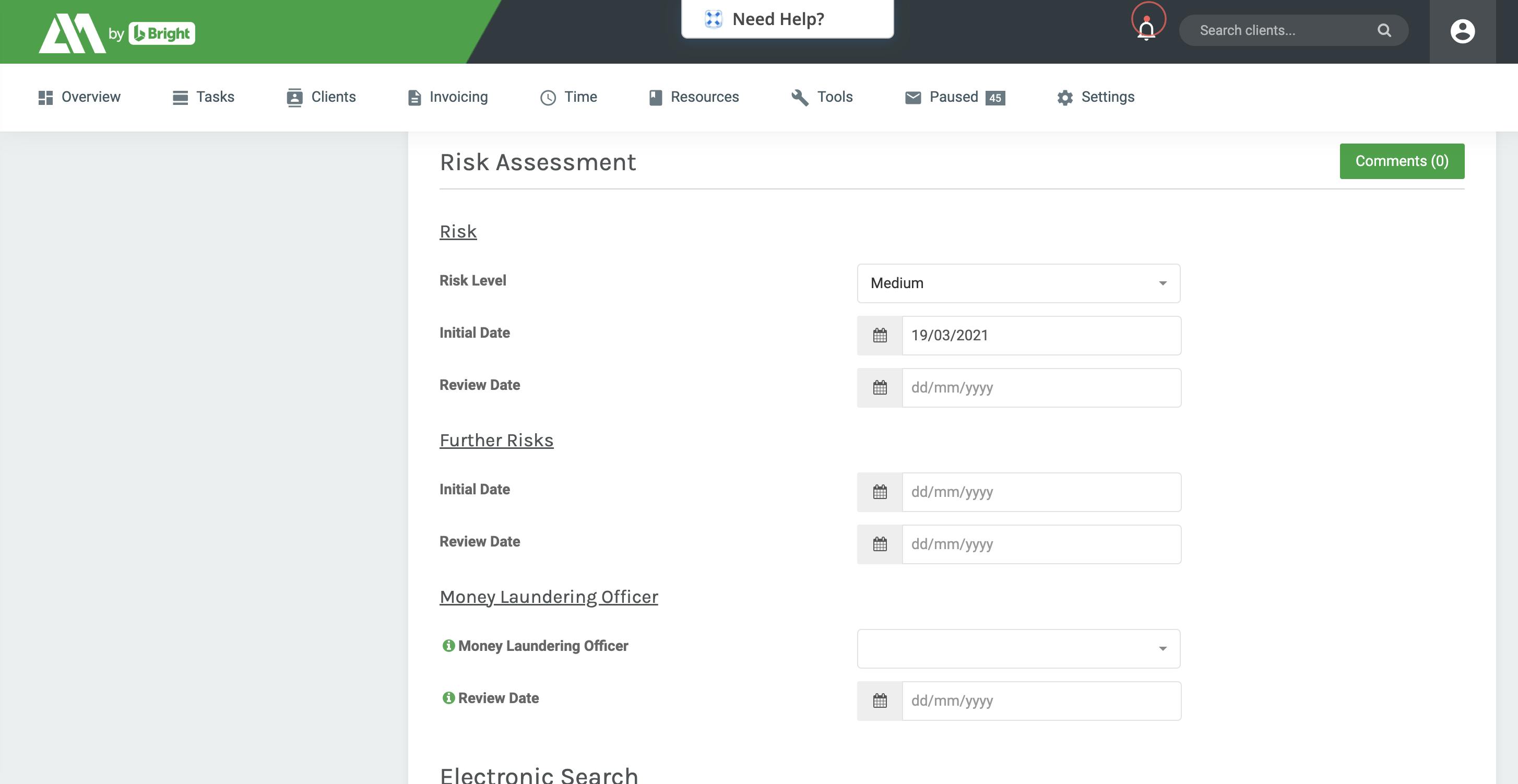

You can undertake risk assessment checklists within AccountancyManager too, which consists of a checklist. In the risk assessment, you enter a variety of details, such as whether they’re a cash-based business and if they have any outstanding tax matters or payments. You can then determine the client as a low, medium or high-risk client, which appears at the top of their profile (see the highlighted “Medium Risk” in yellow near the top of the image below). These risk assessments can be updated as often as you like.

How else can AccountancyManager help protect your firm?

Another way we can help protect your firm is through our client timeline, acting as an audit trail for your firm. It tracks all client activity with your firm (yes, we really mean all client activity – whether they upload a document, open an email, sign a form, you name it). It’s all timestamped too, so should any conflict arise between you and your clients (like a dreaded missed tax payment) you have all the data at your fingertips to protect your liability, proving your firm followed the correct procedures.

Related articles:

- How this Irish accountant transformed their firm

- 7 reasons your business needs to invest in a full-time accountant

- How to unlock more profit with Automatic Enrolment

*The content in this article is not legal advice and should not be used as a substitute for guidelines, advice and regulations from governing bodies.

Interested in learning more about our practice management software?

Book a quick demo of the software today to see it in action.