Enhanced Reporting Requirements: with special guest from Revenue

Thursday, 11th April, 2024 | 11:00 am

With over 30 years in the payroll software industry, trust Bright to support you through Revenue's Enhanced Reporting Requirements.

Since the 1st of January 2024, employers are required to report details to Revenue of certain non-taxable payments made to employees. Revenue has called this Enhanced Reporting Requirements (ERR). Where employers make a tax-free payment under one of the three categories listed below, they must submit the details electronically to Revenue. These categories represent phase one of the new requirement.

Thursday, 11th April, 2024 | 11:00 am

Webinar from 20th March, 2024

Here at Bright, we are actively engaged with Revenue to develop ERR functionality within our payroll solutions.

We have recently developed a more seamless alternative to the ROS manual system, to help you save time and provide more accuracy when reporting. We hosted a webinar on Wednesday, 31st of January, to demo this product. Check it out below.

Bright’s payroll software facilitates ERR reporting

Existing TPM users can access BrightExpenses free of charge

Existing Surf Payroll users can access BrightExpenses free of charge

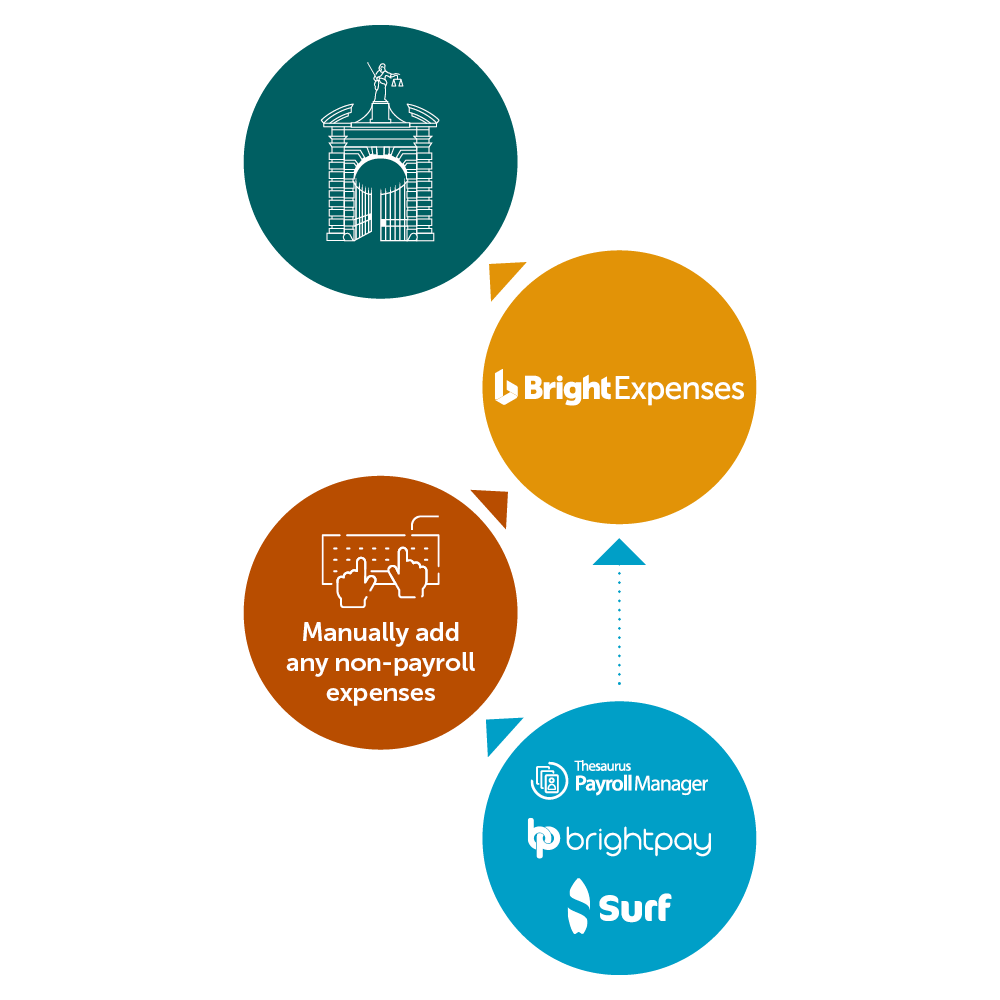

BrightExpenses acts as a seamless alternative to the ROS manual system, saving you time, providing greater accuracy, and offering guidance in relation to qualifying criteria. Plus, you’ll have a backup of documentation required in the event of a query by Revenue.

Expenses processed through the payroll

BrightExpenses integrates with Bright’s payroll solutions, BrightPay, Thesaurus Payroll Manager, and Surf Payroll. This means that any non-taxable expenses entered into your payroll software can be directly sent to BrightExpenses, which can then be sent from BrightExpenses to ROS.

Non-payroll expenses

For any non-payroll expenses, these can be added manually into BrightExpenses, and the information can be sent directly to ROS in the correct format. This keeps all your expenses in the one place, and will be a more seamless alternative to the ROS manual system.

Learn more

For more information, and to keep up to date on Enhanced Reporting Requirements, visit the Revenue website.