BrightPay features you'll love

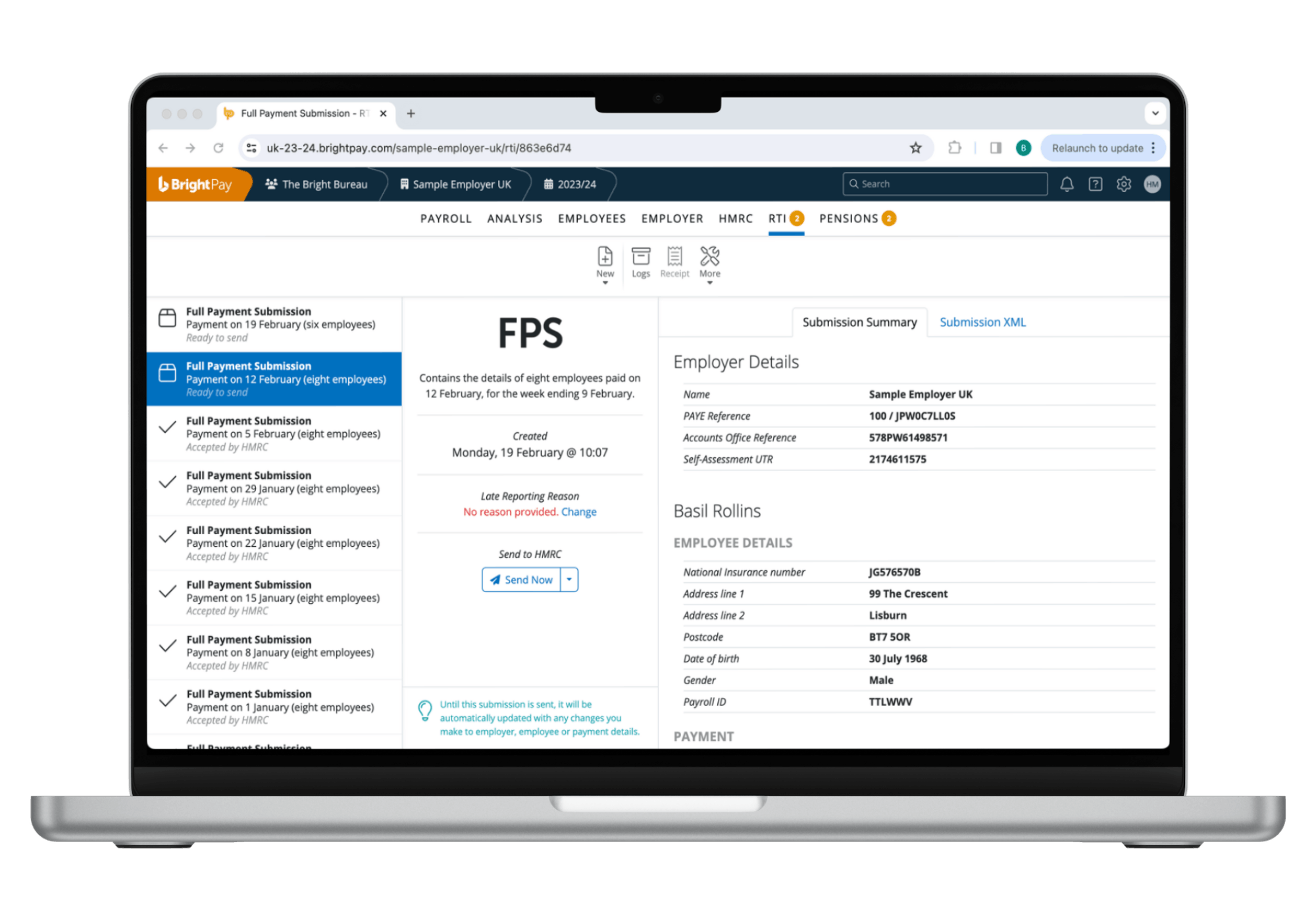

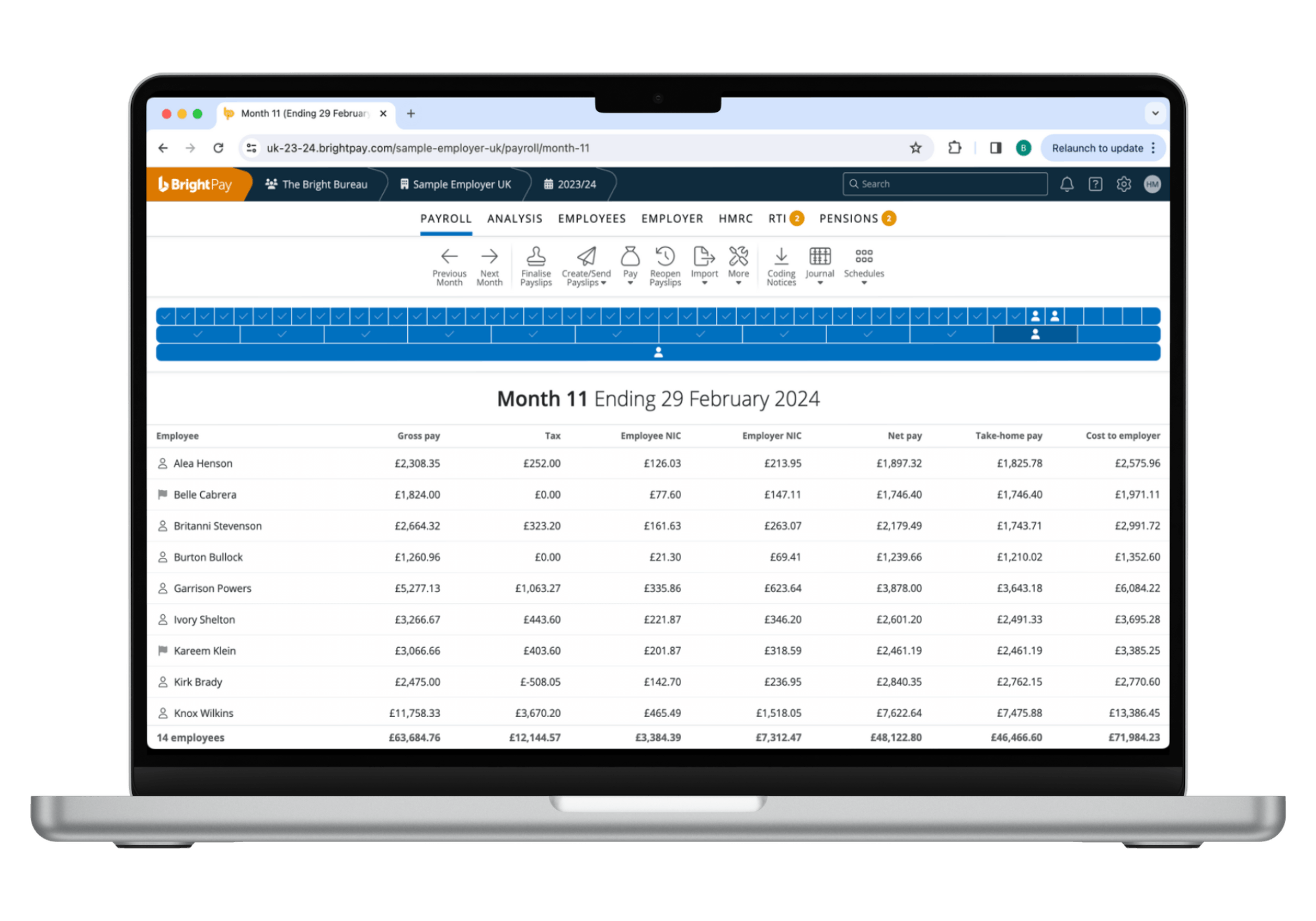

HMRC compliant payroll

BrightPay is fully HMRC Recognised and RTI compliant. BrightPay automatically creates Full Payment Submissions (FPS) as you progress through the payroll year. Other submission types (Additional FPS, NVR, EPS) can be created as required. BrightPay stores all HMRC communication logs, and relays submission errors back to you in a clear, user-friendly format.

Access from anywhere

Run your payroll from anywhere, anytime - all you need is an internet connection.

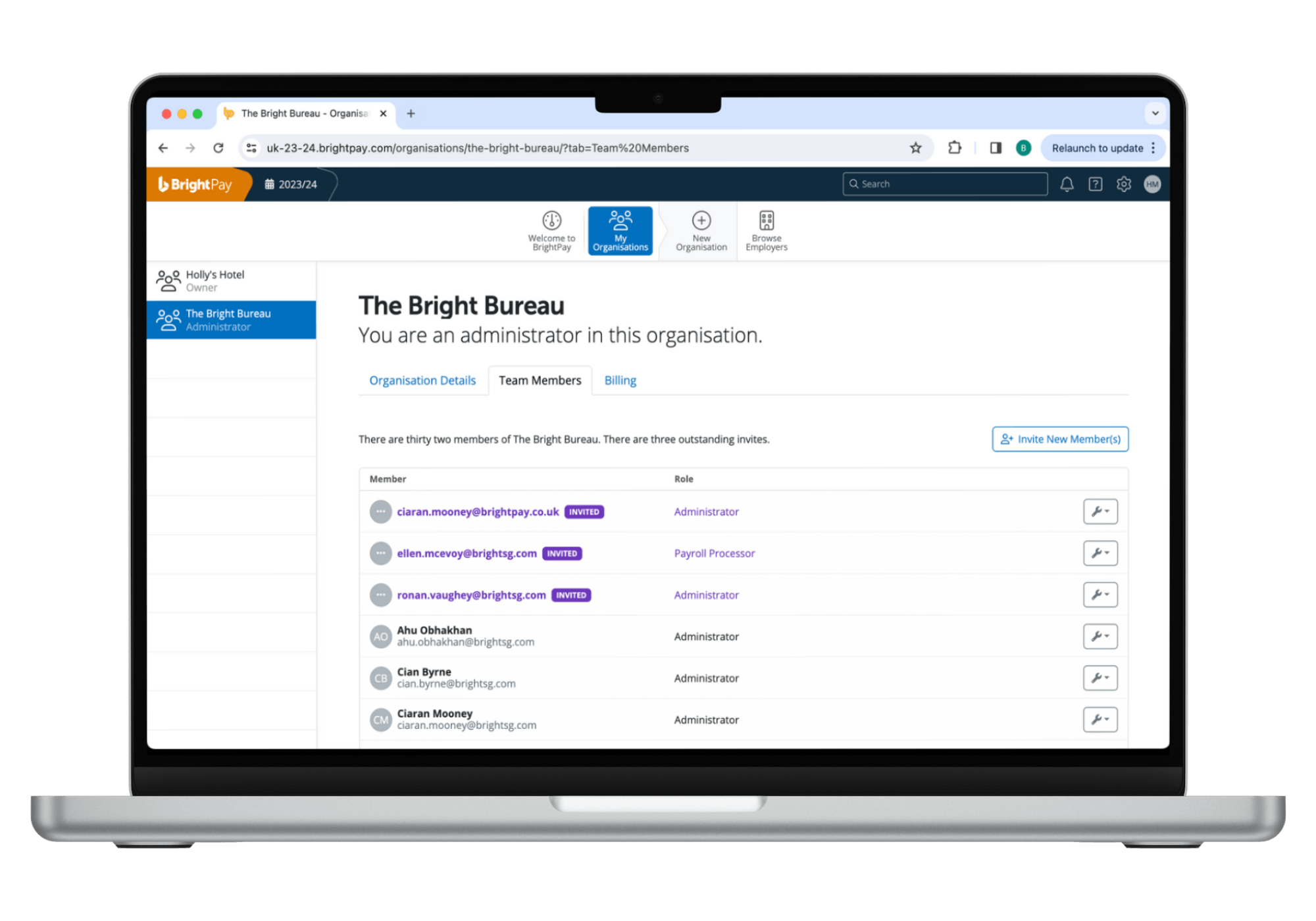

Multi-user remote access

BrightPay takes multi-user capabilities to the next level. Multiple users can access and work on the same payroll file, at the same time. Invite your team, your colleagues, or your accountant, and work on the payroll together.

An unlimited number of users can be added, each assigned one of four permission levels: Owner, Administrator, Payroll Processor, or Billing Manager.

Real-time changes

When you have multiple users working on the same payroll file, at the same time, it's important to have visibility of any changes while they're being made. With BrightPay you can see which user is accessing the company at any given time and what they are working on.

Seeing real-time changes means you won't be doubling up on work and there's less chance of errors being made.

Automatic data backups

BrightPay takes your security measures up a notch by continuously backing up your payroll data, while you work. This means no more having to worry about your payroll data getting corrupted or lost.

The UK's favourite payroll software

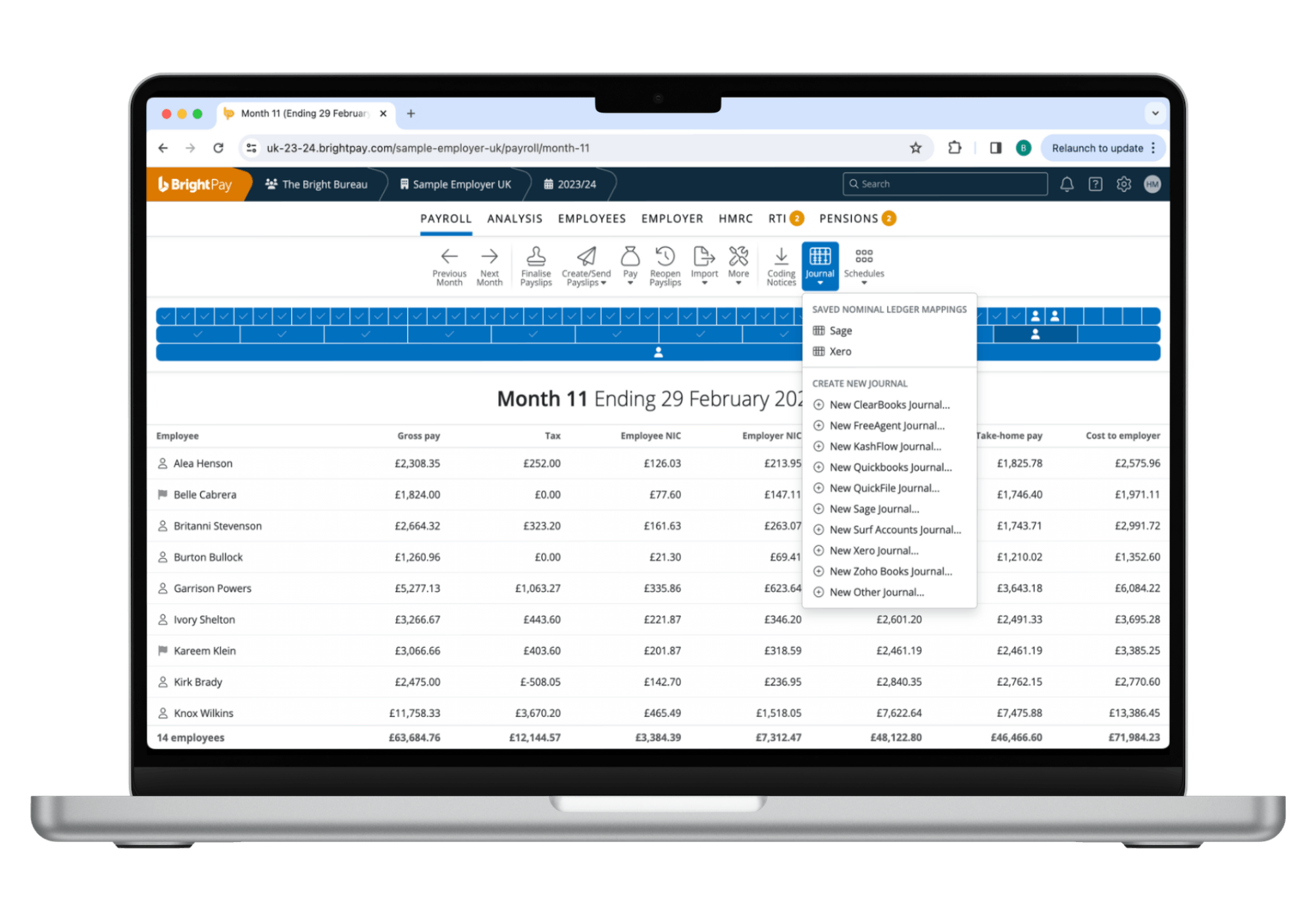

Accounting software integration

BrightPay includes API integration with eight different accounting packages, including Xero, Sage Business Cloud Accounting, QuickBooks Online and many more. This allows users to send the payroll journal directly to their bookkeeping software from within BrightPay.

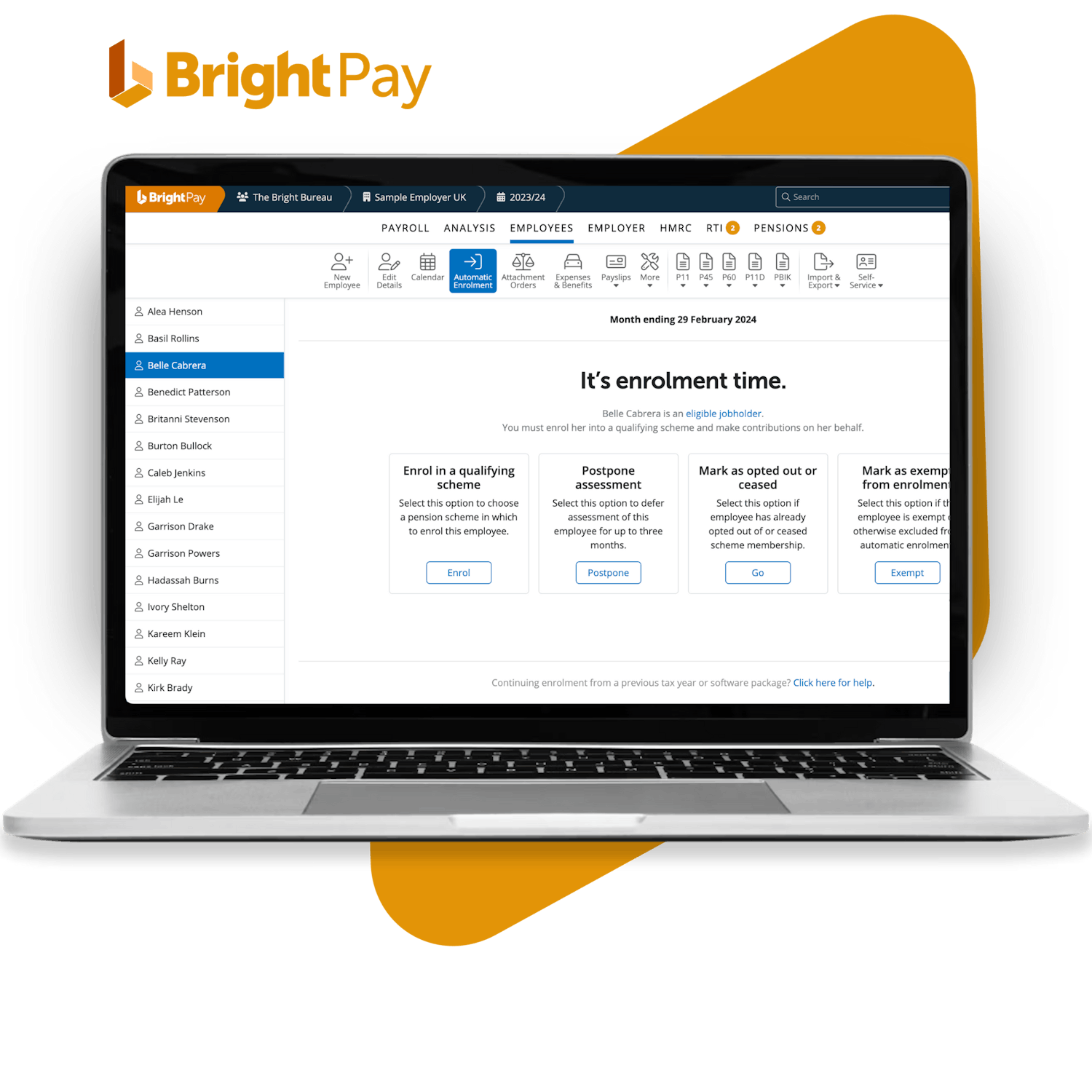

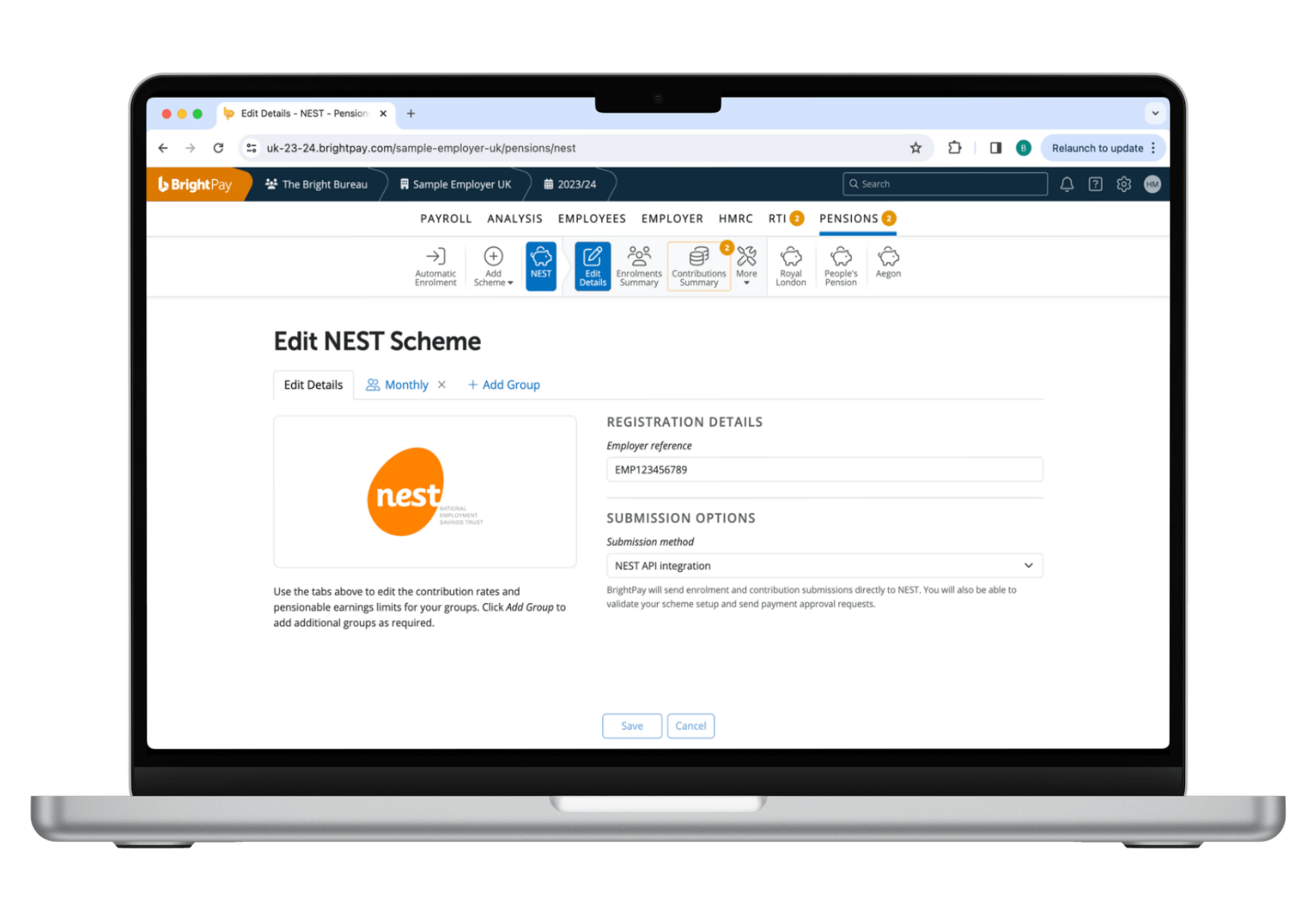

Automatic enrolment made easy

BrightPay includes full functionality for automatic enrolment. Setting up your pension scheme, enrolling employees, issuing communication, making contributions and producing reports – it's all seamless and simple. BrightPay automatically assesses employees, with notifications telling you what you need to do.

Integration with pension providers

BrightPay includes direct integration with NEST, The People’s Pension and Smart Pension so users can send contribution and enrolment files from BrightPay directly to their pension provider's portal.

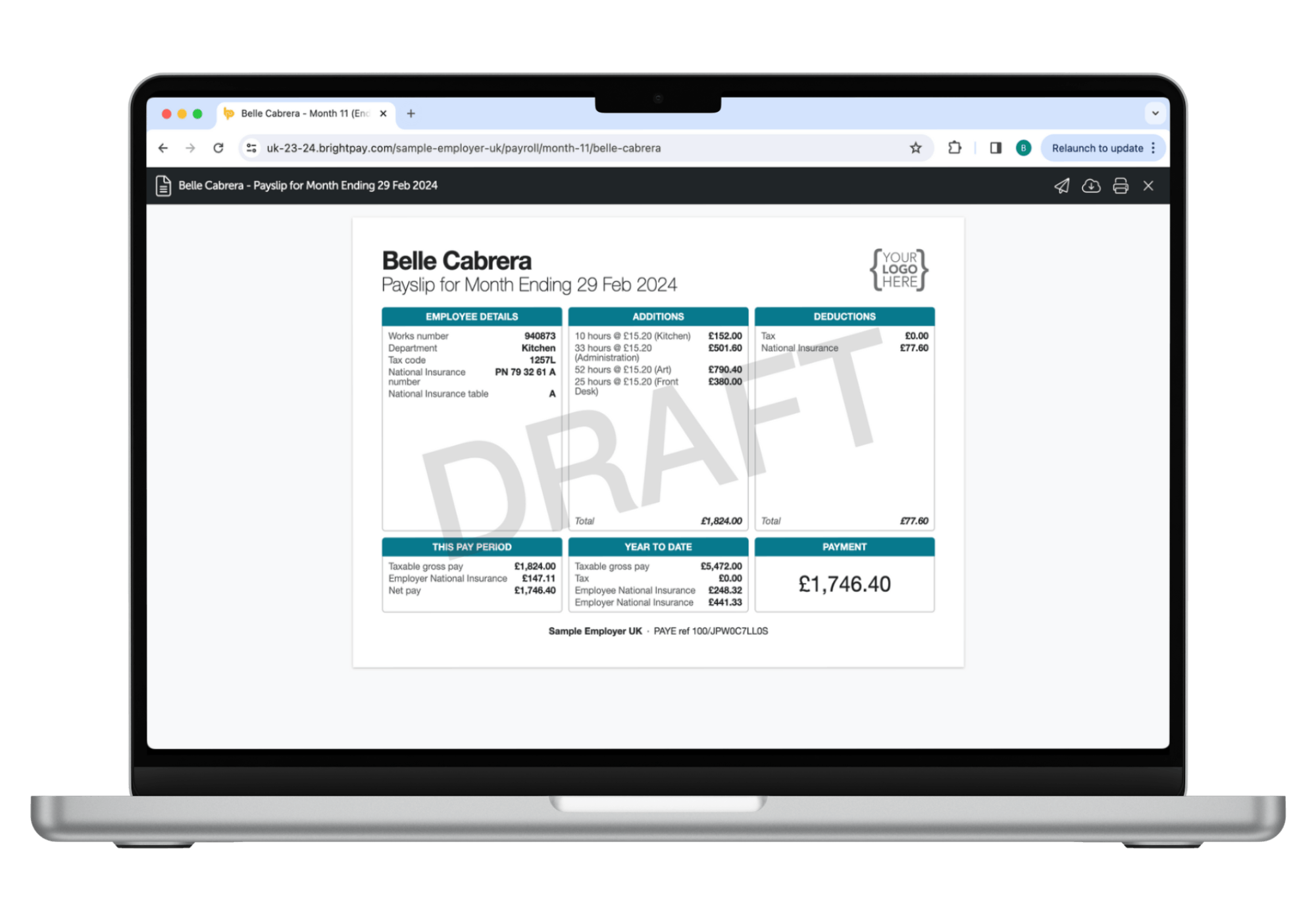

Payslip distribution

Payslips are automatically made available to employees to access through their employee self-service portal. Payslips can also be emailed, printed or exported to PDF.

Payslips can be tailored to add/remove certain information on the payslip, for example, add a company logo or remove the payment method details.

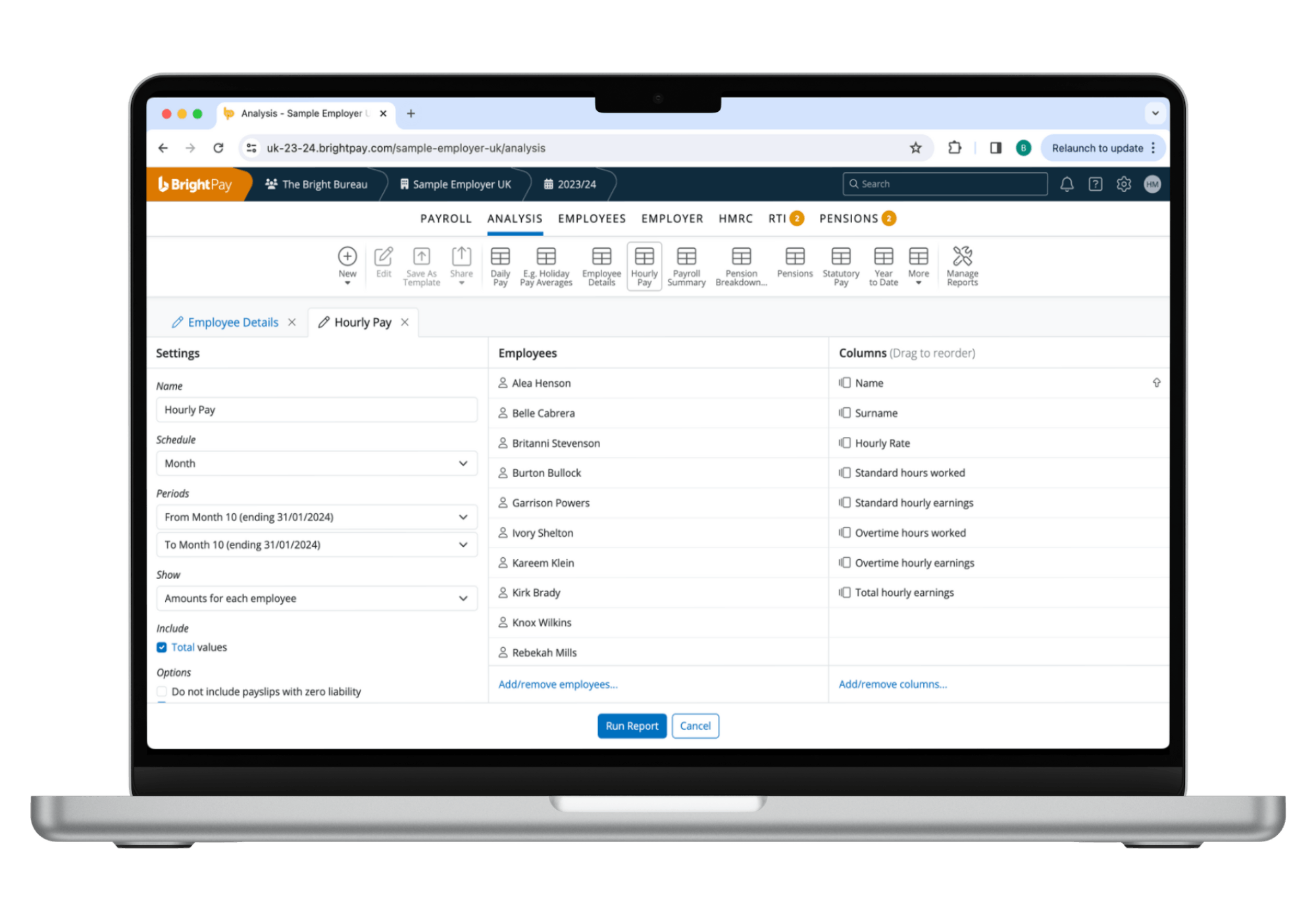

Customised reports

BrightPay includes a flexible report builder where you can create customised reports. Choose from over 100 data items and choose which employees to include in a report. Reports can be emailed, printed, exported to PDF or saved for future use.

Simple to learn and easy to use

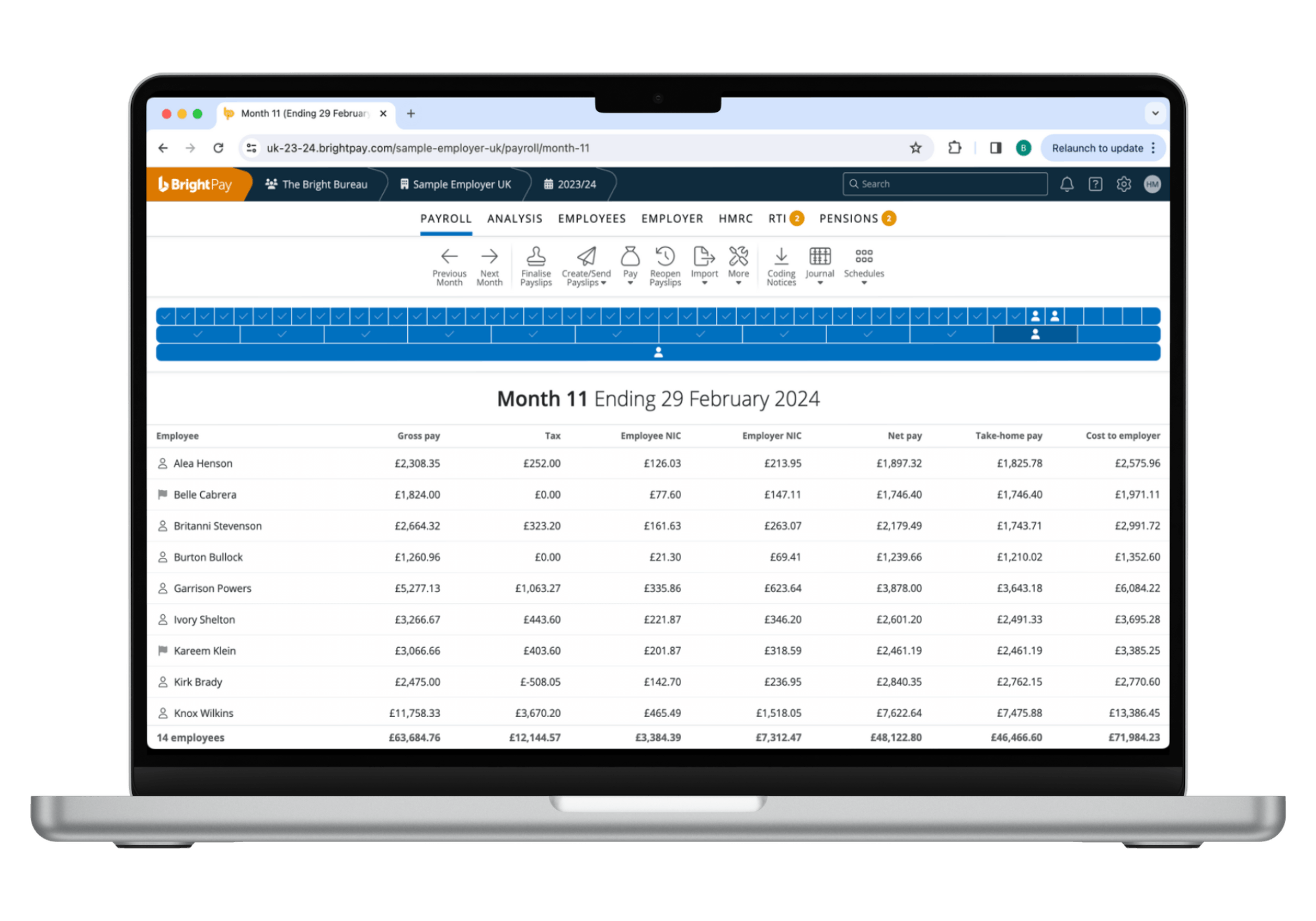

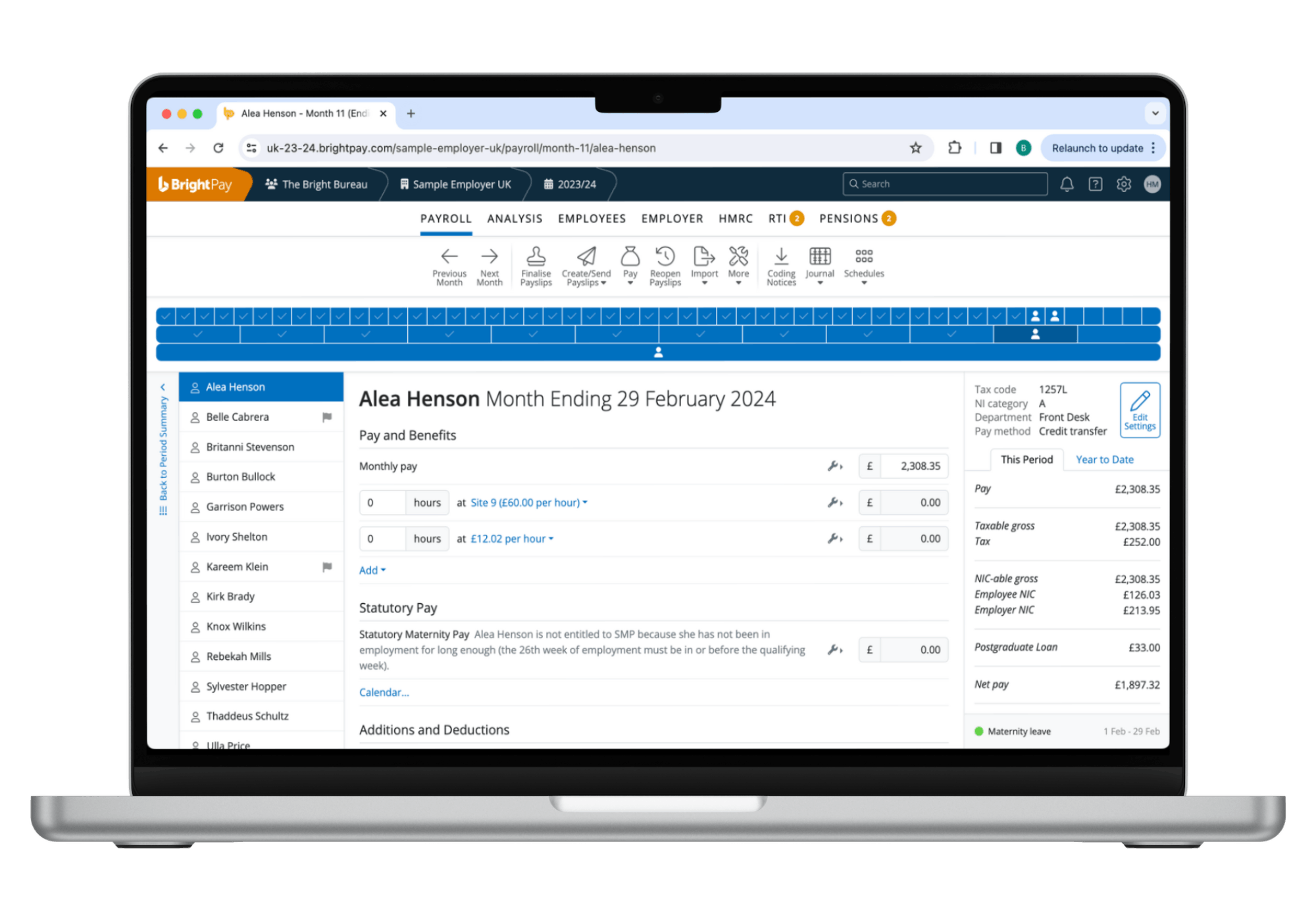

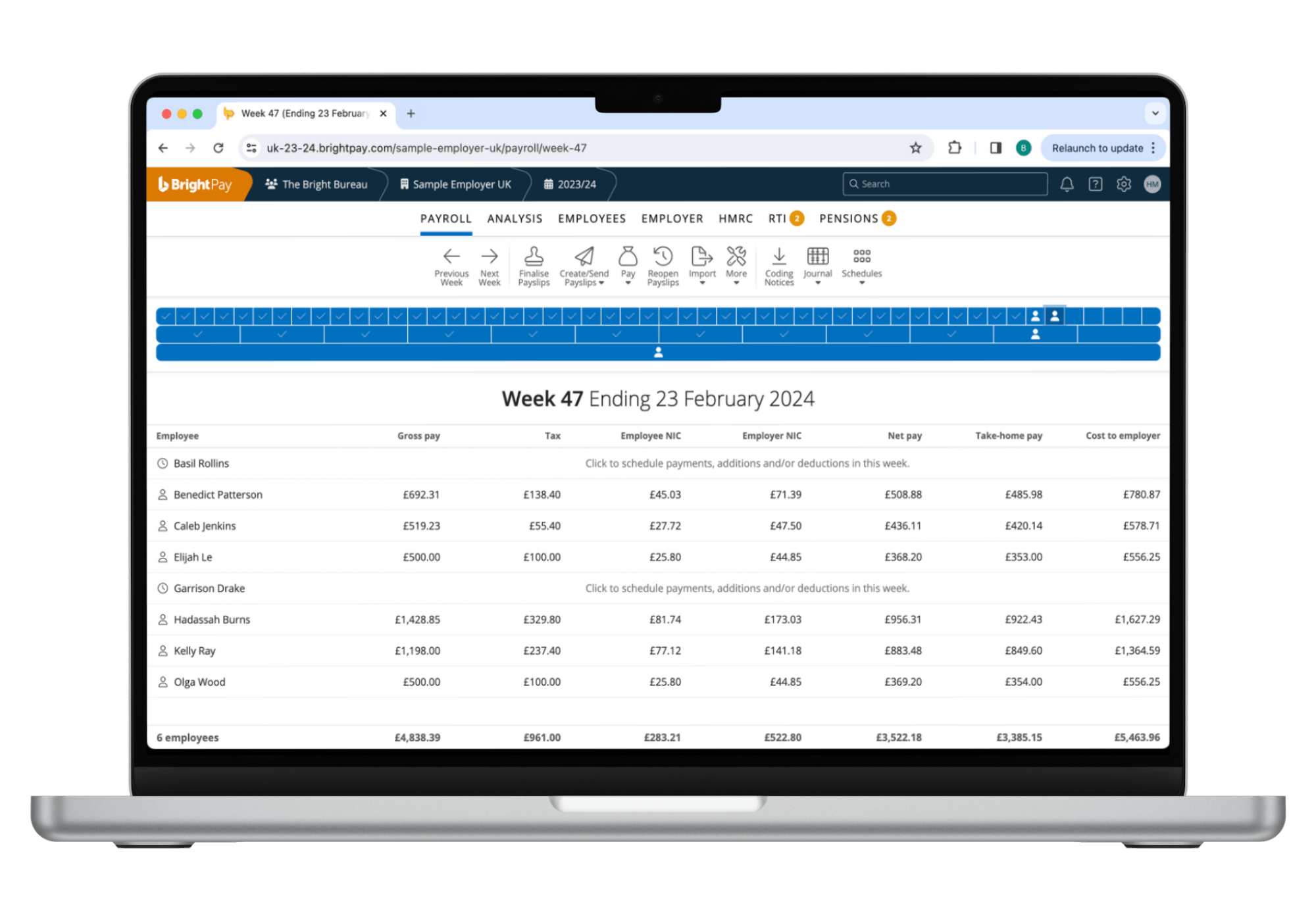

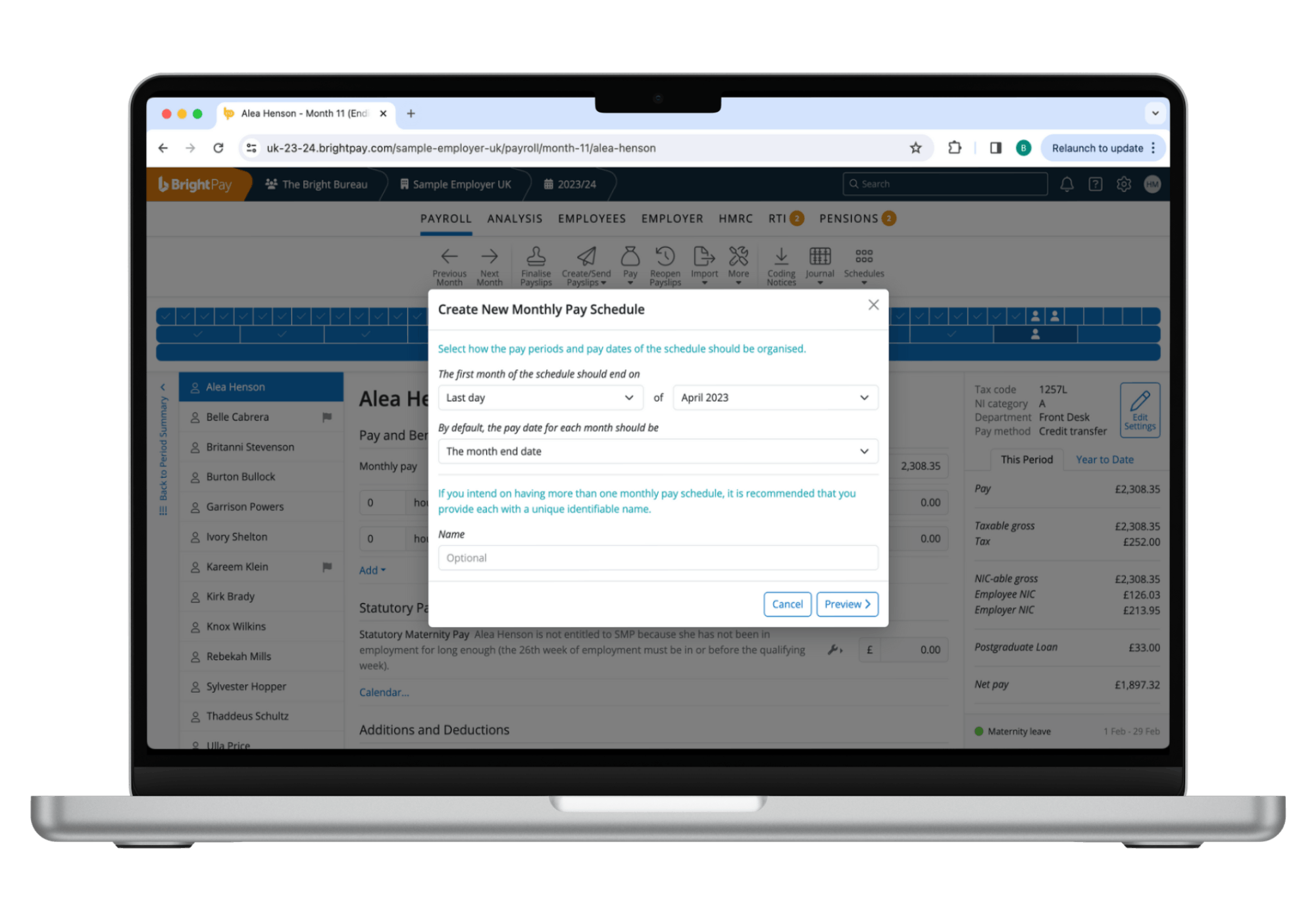

Payment schedules

Process weekly, fortnightly, 4-weekly, monthly, quarterly and yearly payment schedules. Run multiple payment schedules, including those within the same pay frequency, side-by-side with one-click access to any pay period.

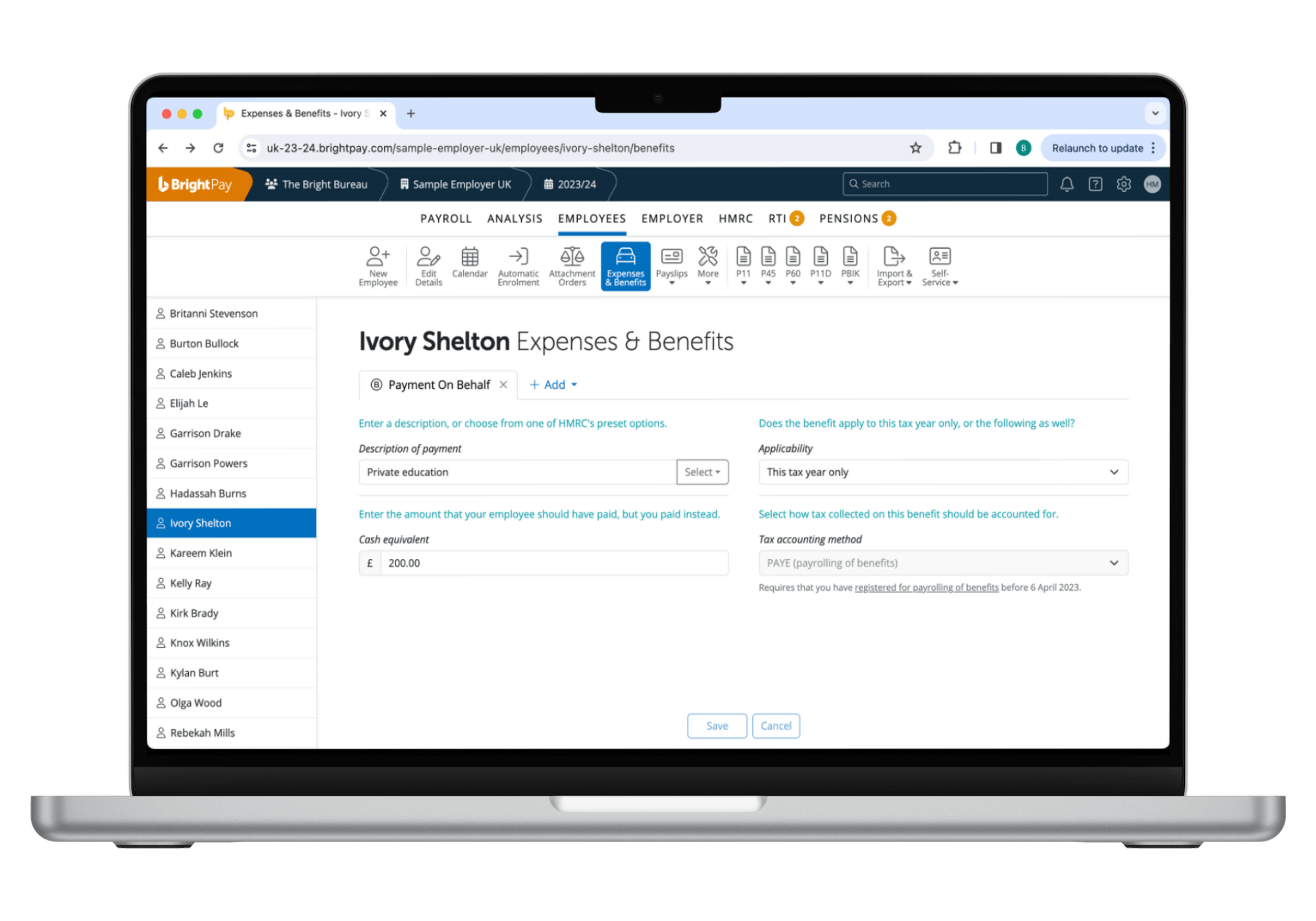

Expenses and benefits

BrightPay allows you to record all types of reportable expenses and benefits that can be provided to employees. BrightPay can produce P11Ds to send to HMRC after year-end. BrightPay also supports Payrolling of Benefits, which calculates the PAYE on expenses and benefits in each pay period. The choice of payrolling or P11D can be set on a per-benefit basis.

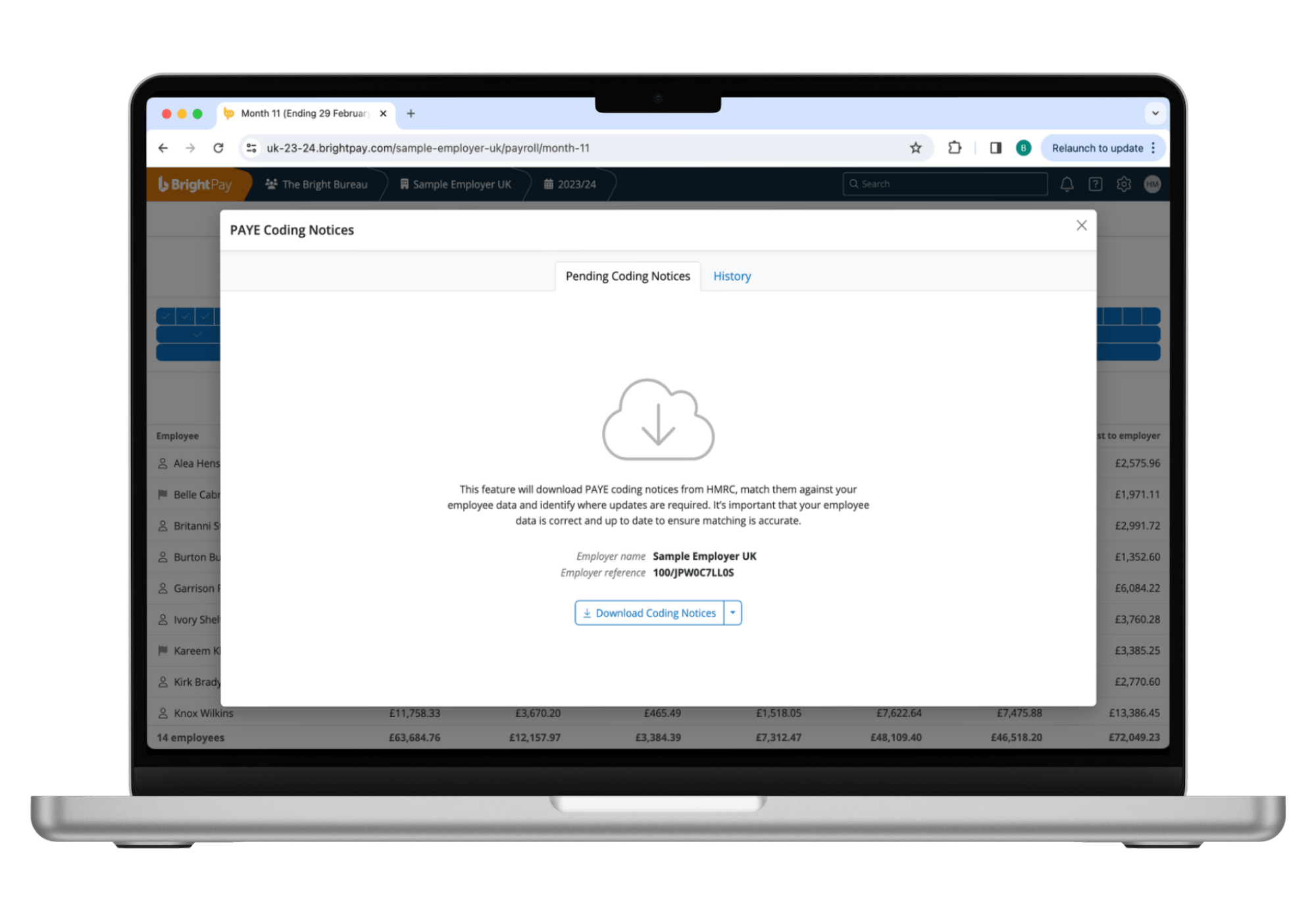

Search and download coding notices

You can now streamline your payroll process by searching for and downloading coding notices directly within the payroll software. This helps to make sure the payroll is always accurate.

Import / update employees with CSV or FPS files

When you upgrade to our cloud payroll software, you won’t need to manually enter employee details. You can simply import and update employees using a CSV or FPS file, getting you set up in no time.

Data hosting

BrightPay securely hosts its data on a remote server instead of storing it on your local desktop, ensuring optimal security measures are in place to protect it. BrightPay utilises the cloud computing service Microsoft Azure to store users’ data, which is one of the leading file hosting services in the industry.

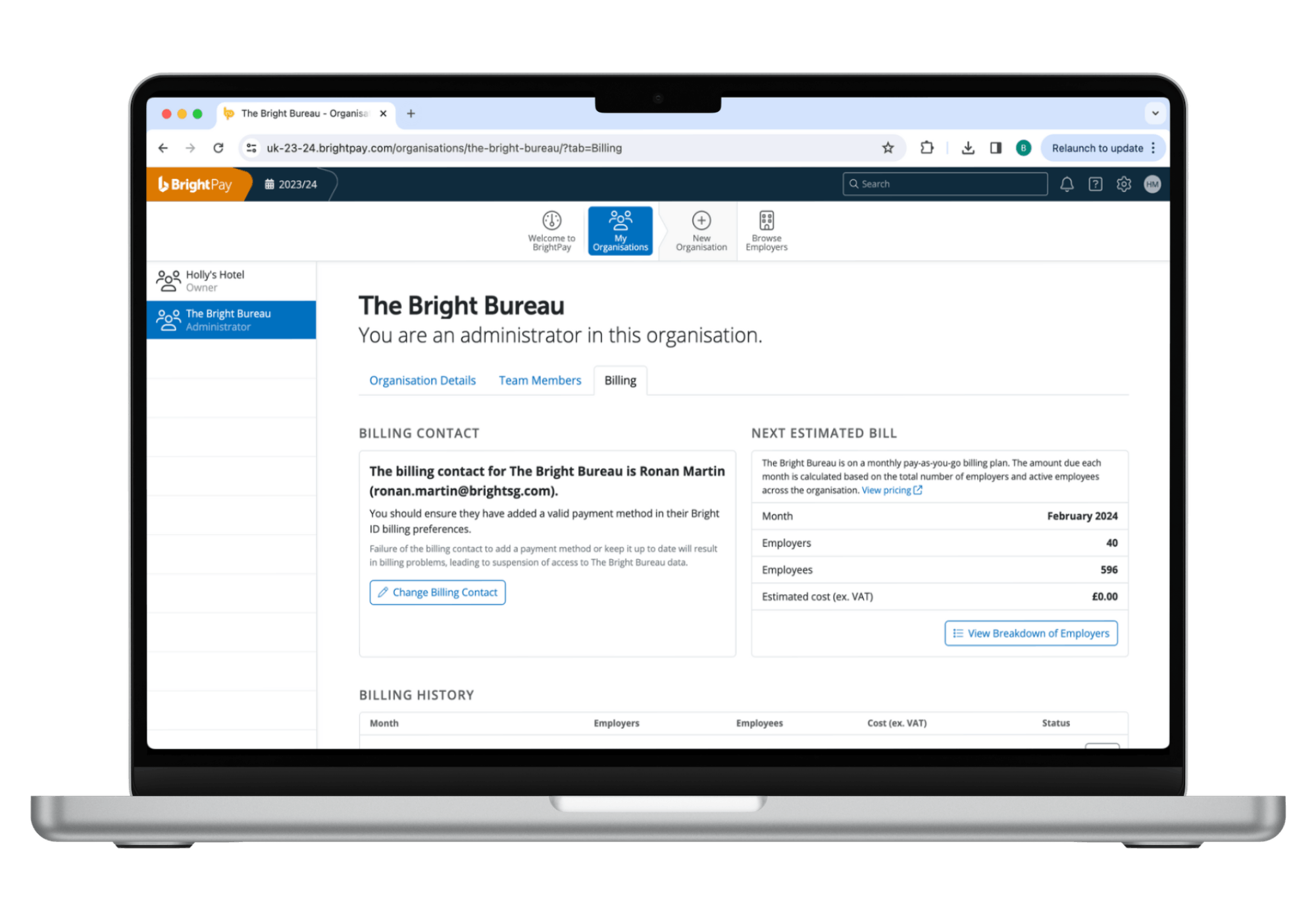

Monthly and annual billing options

You can choose to pay for your licence in a way that suits you. Keep your payroll costs in sync with your business’ revenue by paying monthly. Or, you can pay annually upfront, and we’ll give you a discount.

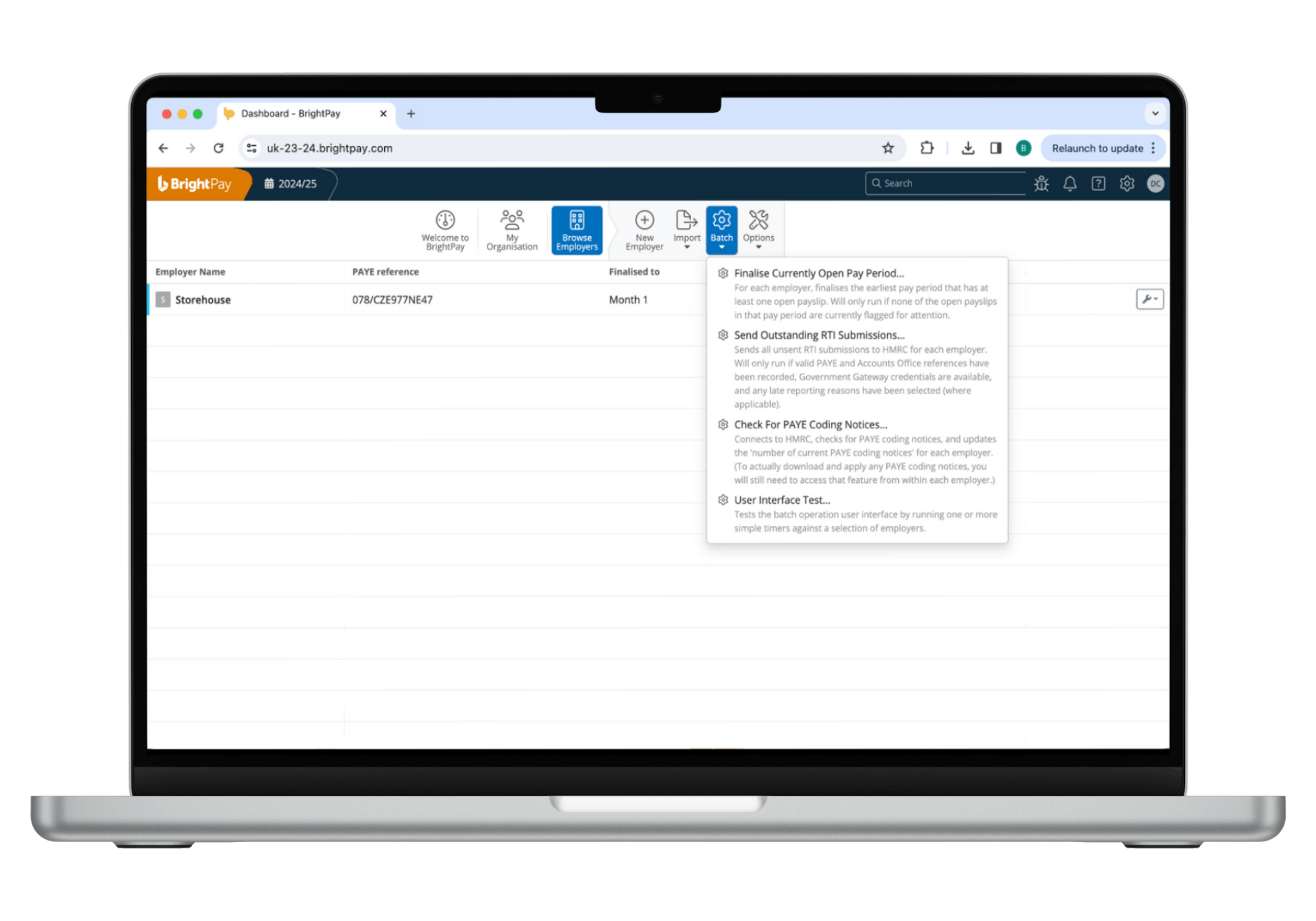

Batch payroll task processing

Work faster and process multiple tasks at once with batch processing for finalising payslips, sending RTIs to HMRC, and checking coding notices.

BrightPay Cloud vs. Desktop – What's the difference?

Learn more