BrightPay Features

A wealth of features that work together to make payroll a breeze.

Payment schedules

Process weekly, fortnightly, 4-weekly, monthly, quarterly and yearly payment schedules. Run multiple payment schedules side-by-side with one-click access to any pay period. Add unlimited payments, additions, deductions and attachment orders to a payslip and assign an employee to one or multiple departments.

Payslip distribution

Payslips can be emailed, printed, exported to PDF, or added to our employee self-service portal, BrightPay Connect. Payslips can be tailored to add/remove certain information on the payslip, for example, add a company logo or remove the payment method details. Employees can be paid by Faster Payments, credit transfer, cheque or cash.

Revenue compliant

BrightPay includes full functionality for PAYE Modernisation and is Revenue compliant. BrightPay not only ensures you are kept fully compliant with your employer requirements, but makes it really clear and easy too. Retrieve Revenue Payroll Notifications (RPNs) each pay period and update employees as required. Send Payroll Submission Requests (PSRs) each pay period.

Get started now

Customised reports

BrightPay includes a flexible report builder where you can create customised reports. Choose from over 100 data items and choose which employees to include in a report. Reports can be printed, exported to PDF or saved for future use. Reports can also be made automatically available on our online employer dashboard, BrightPay Connect.

Accounting software integration

BrightPay includes payroll journal API integration with several accounting packages, including Xero, Sage Business Cloud Accounting, QuickBooks Online and many more. This allows users to send the payroll journal directly to their bookkeeping software from within BrightPay.

Pay employees through BrightPay

Get ultimate convenience with real-time and 24/7 payments using BrightPay’s integration with the payment platform Modulr. It’s a fast, secure and easy way to pay employees, subcontractors and HMRC through BrightPay. There’s no need to create bank files or become a Bacs Approved Bureau.

Batch payments featureGet started now

Benefit in kind

PAYE, USC & PRSI must be operated by employers in respect of the taxable value of most benefits in kind and other non-cash benefits provided by them to their employees. BrightPay allows you to process all types of benefits that you provide to your employees.

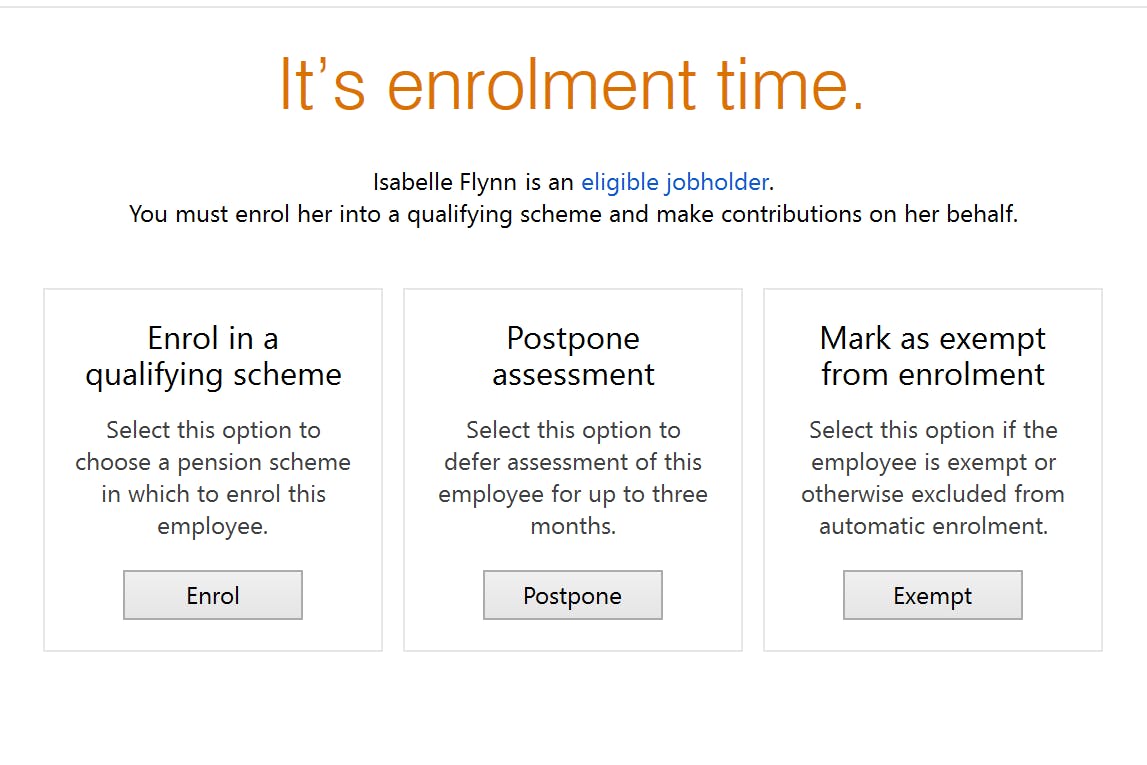

Automatic enrolment

(Expected 2024)

The Irish Government has set a date for auto enrolment to be rolled out in Ireland. From 2024, employers will be required to enrol their employees into a workplace pension scheme and contribute towards the employee's pension pot. All BrightPay payroll packages will include auto enrolment functionality. We have the experience to guide you through the process after rolling out a similar system in the UK in 2012.

Multi-user remote access

BrightPay licences can be installed on up to 10 PCs. This means that payroll processing is possible by up to 10 users, or from 10 different locations. When used alongside BrightPay Connect, the software will automatically alert you if another user is in the file to prevent the risk of conflicting copies. BrightPay also reminds you to use the most up-to-date version of the file if it detects multiple connected payroll files.

Get started now

Safe and secure

All payroll data for an employer is contained in a single file for simple backup and transfer. Sensitive data is encrypted in the employer file. Employer files can be optionally password protected. Employer files can be stored on a cloud file sync service such as Dropbox, OneDrive or Google Drive giving you access to the employer files from multiple PCs. Payroll data can also be automatically backed up to a secure online server every 15 minutes, using BrightPay Connect.

BrightPay Connect

BrightPay Connect is a cloud extension to BrightPay, introducing automatic cloud backups, an online employer portal and an employee self-service app. BrightPay Connect enables employers to link payroll and HR in a way they never thought possible, with HR document distribution, an employee leave management tool and much more.

Find out moreGetting started with BrightPay

BrightPay allows you to bring across your company and employee details from various payroll packages, including HMRC Basic PAYE Tools, Moneysoft, Sage and many more. Start at the beginning of the tax year, in the middle of the tax year, or continue partway in the tax year from migrated payroll records.